You’ve probably heard people talk about how to use a cash envelope budget to save money and help you get out of debt. But what if you don’t want to use cash? Does that mean you can’t use envelopes? Nope. Not if you follow one of the cashless cash envelope methods available.

If you follow any money advice, you’re usually taught about using cash and implementing the cash envelope system. That’s the budgeting method I recommend here on our site.

Even though a cash envelope system is the perfect solution for our family (and was one of the catalysts for our debt payoff plan), I understand that it’s not an option for everyone. Even if you don’t use cash, you still should budget and spend as if you do.

If you’re just learning about budgeting, you’ll want to check out our How to Budget page. There you’ll learn everything you want to know about how to start budgeting.

A cashless envelope system is a way to use cash envelopes without using cash. The idea is simple, but there are different ways to track this budgeting method.

HOW DOES A CASHLESS CASH ENVELOPE SYSTEM WORK?

The idea is the same as the regular cash envelope method. You have a budget and need to ensure you don’t spend more than you should.

Each pay period, you record the amount budgeted for each category onto your “envelope.” As you spend, you keep track of it. When you’re out of money, you can’t spend anything else in that category.

Using the cash envelope system without using cash can work – if you want it to.

WHY DOES THIS METHOD WORK?

When you’re trying to get control of your finances, you need to know where you spend. The best way to do this is to track your spending. Not tracking after you spend – but as you purchase.

Most of the time, you swipe your credit or debit card without really thinking about it. This action can easily throw your budget out of balance.

While using cash has emotion attached to it, tracking every purchase requires awareness. You’re always watching what you spend and where. There are no surprises, such as that you spent $250 on groceries when the budget was $200. You see it happening right in front of you.

The cashless envelope system works because:

- You don’t have to worry about carrying or getting cash.

- It forces you to track your spending in real time.

- You can see exactly where your money goes and make budget adjustments as needed.

The cashless envelope system forces you to be more responsible for your spending without the hassle of carrying money.

CASHLESS CASH ENVELOPE SYSTEMS TO TRY

When you’re ready to try a cashless system, you need to determine which is the best for you. You can find one on your phone, and there’s also a printable option.

CASHLESS CASH ENVELOPE APP

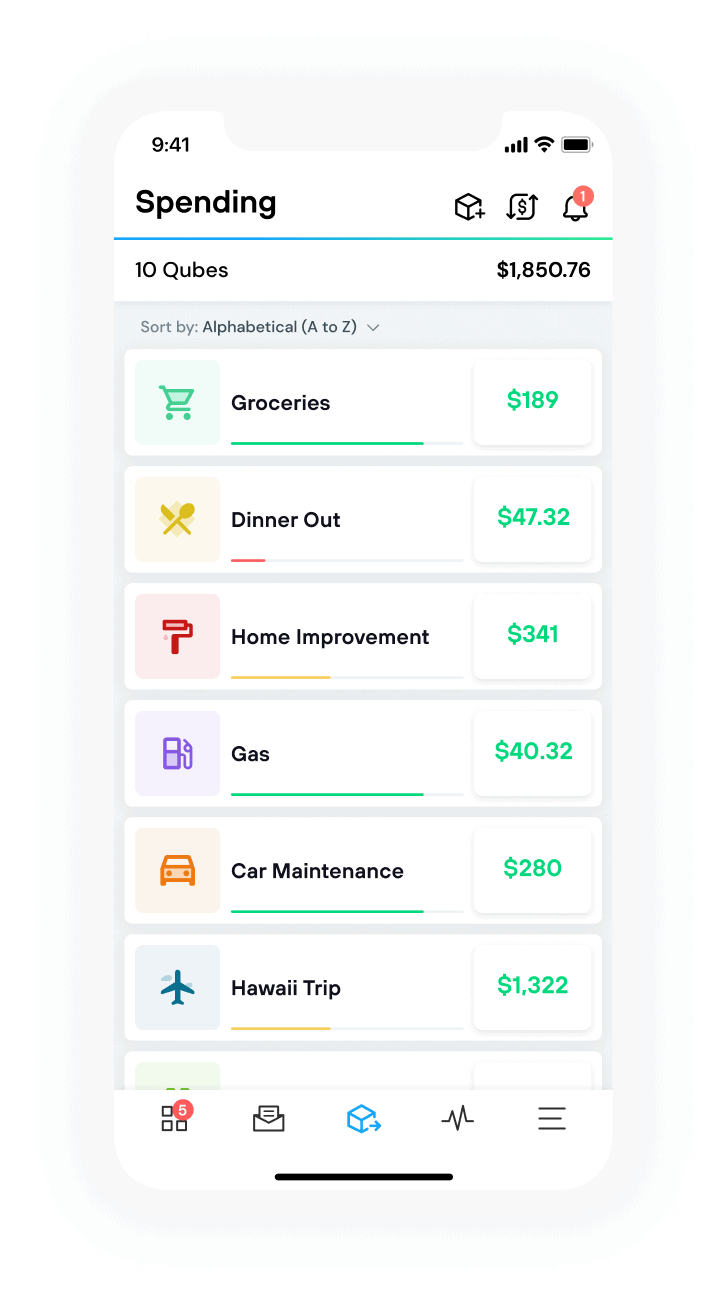

Several apps claim that they can help you keep track of your spending with virtual envelopes. If you’ve found one that works well for you, then I say keep using it! But if you’re new to this idea – or want something new – the app I recommend is Qube Money.

Qube Money has three plans from $0 to $15 per month.

To start, add the app to your phone – or you can use their online site (which I love). Once you do that, sync your various accounts. Make sure you include the cards you’ll use for your various categories.

For example, you may charge every purchase to your credit card to earn rewards or cash back. If you do this, you will connect your credit card. Some people may use a debit card for some purchases and a credit card for others. Those of you who do this will connect both the debit card and the credit card to your account.

Then you just swipe as usual. Every time you make a purchase, the purchase amount is deducted from your online envelope. With a couple of swipes, you see not only how much you have left to spend but also where you spent your money. There’s no guessing with the cashless envelope tracker.

This system helps you give every dollar a job. You know where it will go even before you spend it. Using Qube Money puts you back in control.

Qube Money’s free basic plan will be more than enough for most people, but there are other plans that automate your budgeting more or to include the entire family.

As I said, you don’t need to purchase one of the larger plans because the basic plan will meet most people’s needs. But it’s great to have these options available at your fingertips.

Related: The Best Apps for Your Budget

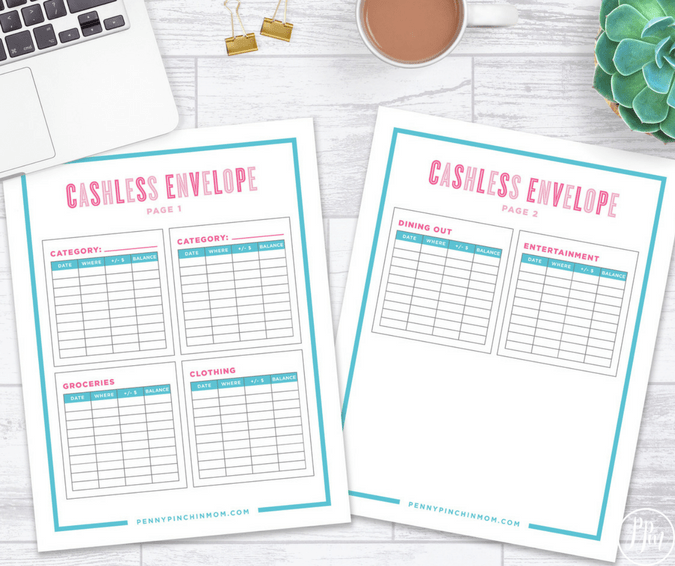

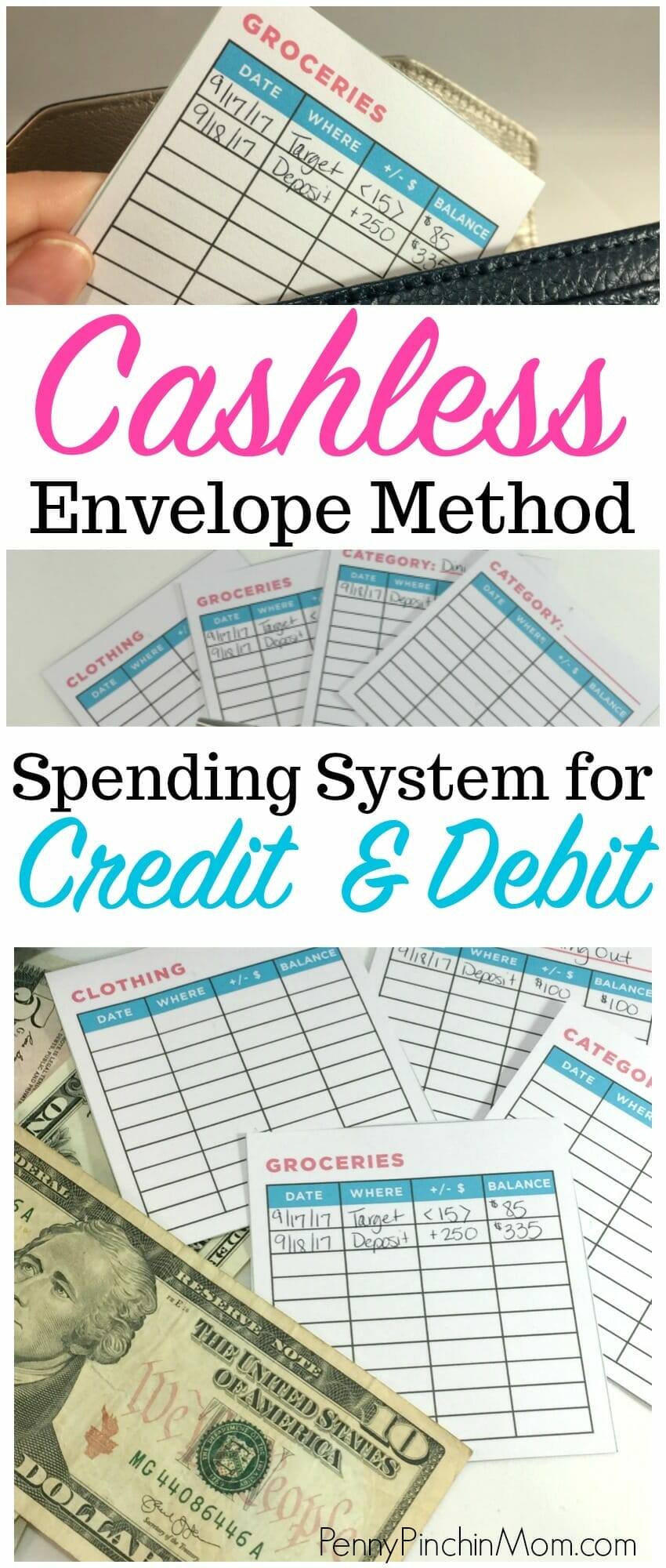

CASHLESS ENVELOPE PRINTABLE

Apps are great, but there are times when you’d rather have the simplicity of writing something down rather than having to pull it up on your phone. That’s where the printable cashless envelopes come in handy.

These work the same way as regular envelopes – just without cash. Print them and keep them handy. Record the budgeted amount for each budget category at the top of the envelopes. Then as you spend, keep track of it. Jot down every purchase, and keep a running total of how much you have left to spend.

I get that it’s a pain to keep track of cents, so I recommend you round up. For example, if your grocery budget is $200 and you spend $105.74, record that you spent $106 and have $94 left to spend. That is MUCH easier than keeping track down to the penny. (Truth be told, this is what I do with our cash envelopes, too.)

Once you reach your spending limit, then you’re done with that category! If you budget $100 for such variable expenses as dining out and there’s just $5 left, don’t pick up that coffee and cake for $7 – or you will have just busted your budget! If you find that you’re always out of money in select categories or often have money left over in other categories, then it may be time to make adjustments to your budget.

Grab your cashless envelope budget printable. I don’t recommend that you print these on regular paper because that is really thin and will tear easily. Purchase card stock to use to print out your cashless envelopes because they will be more durable.

Related: How to Figure Out How Much Money to Budget For Groceries

Even if you don’t want to use cash, it’s still essential to continue to track your spending so you never exceed your monthly budget.