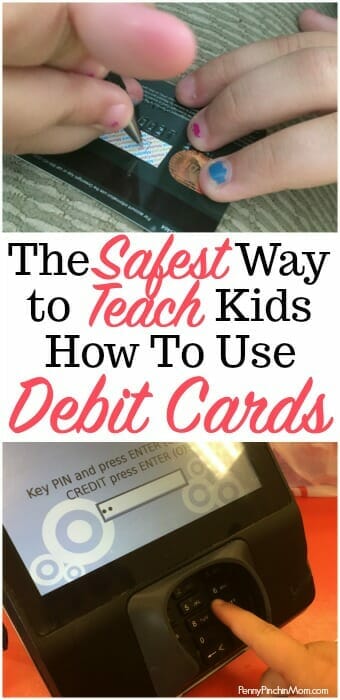

Teaching kids about debit and credit are lessons every parent needs to address. After all, if you don’t teach them – who will? We found a safe way to show our daughter how to use debit (in a way we can control).

If you are a parent, you know they grow up fast. One day you bring them home from the hospital and put them in their crib. When you look again, they are 13 years old. OK, well, not exactly like that, but it certainly feels like it!!!

As our kids grow, we teach them things they need to know. We teach them how to brush their teeth and care for themselves. They learn how to cook and clean. They learn about the birds and the bees. We make sure they contribute to society, rather than take from it.

We also make sure our kids understand finances and money. It’s easy to explain this concept when kids are young, but what about when they get older and need to use debit and credit. The idea of money in the cloud can be hard to understand.

TEACHING KIDS ABOUT DEBIT & CREDIT

Cash and coins are tangible. You can hold them in your hands. Kids can count it to see how much they have. But, hand them a debit card, and it is an entirely different ball game.

Now, they have a piece of plastic. Your child has to remember a pin code. There is the issue of learning to budget and knowing how much money they have to leave for spending. That’s a lot to learn!

You can try different methods such as practicing at home with your card, but that isn’t real life. As we know, the best lessons in life are those you figure out on your own. But, with a debit card? Is that the smart thing to do?

THE SAFE DEBIT CARD FOR KIDS

You would not hand your child the keys to a brand new car without them knowing how to drive. They could cause an accident. They would not be safe on the road. Not the smartest way to teach your kids about driving and automobile safety.

Why would you do this with money?

Handing your child a debit card with unlimited access to funds doesn’t make sense. Also, what happens if they lose the card? They risk losing all of the money they have in the bank too. That helps no one.

My husband and I face this challenge with our oldest, who is 13. We know that she has to learn how to use a card, but we were nervous about her having free reign with a card when she is just learning the concepts.

I then learned about Greenlight. It was the perfect solution to what we needed to teach our kids about debt.

WHAT IS GREENLIGHT?

Greenlight is the debit card for kids that parents manage directly from their phones. You can control the amount, spending and more. Greenlight is a debit card with 100% parental control.

HOW DOES GREENLIGHT WORK?

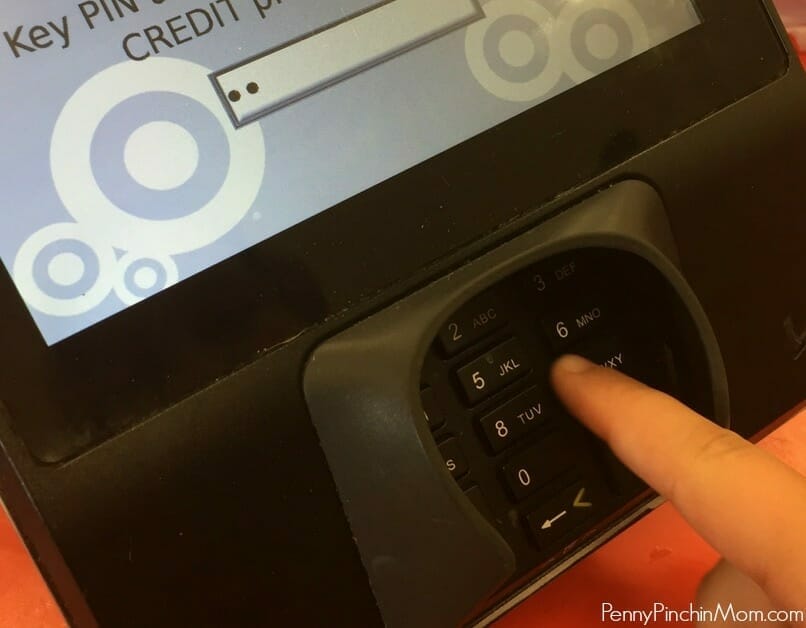

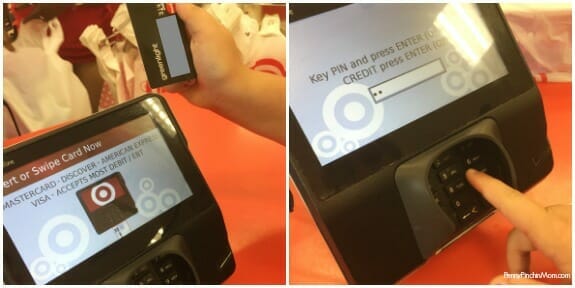

The concept is pretty simple. First, you download the app to your phone and fill out your profile. Then, transfer money from your bank account and deposit it on your child’s card. They get a card with their name on it and even select their PIN (so they can remember it).

Your child uses the card exactly like a debit card. But, much safer.

HOW MUCH CONTROL DO YOU HAVE?

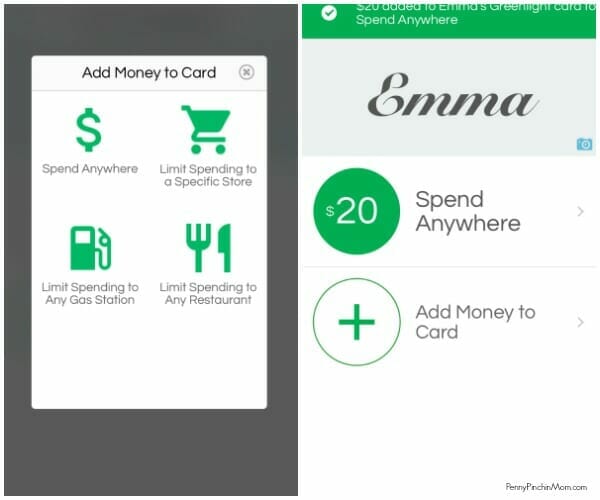

As a parent, you have complete control. You can decide how much to put on the card and set limits on spending at stores, restaurants and gas stations. That way, if you give them $20 for gas, they can’t put just $5 in the tank and blow the other $15 at the movies. They must use it at the gas station.

Not only that but when your child shops, you get a notification. That’s right! You can track every penny your child is spending and where he or she spends it.

If the card gets lost, you can turn it off right from your phone. There might also be times when you are suspending spending (you know, when your child is grounded). You can turn the card off. Then, when they are allowed to spend again, turn it back on.

Finally, you can set a regular allowance or do one time transfers. If you want to give your child $20 for a night out, you can add just that amount. You can also set up regular allowances on a recurring schedule, and those amounts will be funded directly on the card for you.

We started out small with our daughter and put $20 on it. I knew she needed a new blow dryer, so we used that as an opportunity for her to use it for the first time. It worked just like your debit card – right down to the pin.

I am able to see that she spent how much she spent – down to the penny – right on my phone! It shows me that she paid $18.54 at Target and there is $1.46 left on her card.

HOW THIS TEACHES KIDS

This card teaches the fundamentals and understanding of debit. It shows your kids, in real time, how much money they have to spend and how much is left on their card to spend.

When you apply limits to different types of spending, it teaches your kids budgeting and control. By linking their phone to your account, they can track purchases their devices. They know every minute how much they have to spend.

HOW IS THIS DIFFERENT THAN A DEBIT CARD?

When your child has a traditional debit card, it is attached to a bank account. If they lose the card, it can still be used. A traditional debit card has more risk of money in your account being used by a thief.

Greenlight offers a solution that is also safer than cash. If they lose $20, they are out that money. But, if they lose the card, that money is still safe and can be put onto the new card.

WHAT DOES IT COST?

If anyone knows me, they know I hate paying for things that aren’t necessary. Since Greenlight offers a 30-day free trial, I figured we’d try it out for that time and then cancel. But, now that we’ve used it, both my husband and I think it is a smart monthly investment.

After the 30 days is up, the cost is just $4.99 a month, for up to five kids. While you can cancel at any time, you won’t want to until your kids are old enough and ready for a bank account with debit/credit access.

Greenlight fills a need for our family that we didn’t even realize was missing. It is an investment in teaching our children financial responsibility. Isn’t your child worth that?