There are many types of budgets you can try. A quick Google search will show you lots of options, including the cash envelope budget. If you say it doesn’t work for you, you didn’t try doing it the right way.

Whether you’re getting out of debt or not, you can probably use some help in making sure you control your spending. Contrary to what many people say, the best way to do this is to use cash. If you’re trying to get out of debt, the cash envelope system is an important step in your debt paydown plan.

Many financial experts, such as Dave Ramsey and Clark Howard, agree that using cash is an important factor in controlling your spending. And it’s a system not only for people trying to get out of debt. Cash envelope budgeting is for everyone because it really makes you think more about your spending.

If you’re just learning about budgeting, you’ll want to check out our How to Budget page. There you’ll learn everything you want to know about budgets and budgeting.

HOW TO USE THE CASH BUDGET

WHY A CASH ENVELOPE SYSTEM?

Cash is king!! I say this all of the time because I genuinely believe it. When I bring up using cash, the first rebuttal I get is “If I have cash, I spend it far too easily.” Sorry, I don’t buy it. The main reason people fail on a cash budget is because they don’t track what they spend and assign it a task.

The truth is that when you use cash, you spend more wisely. When you have only $200 for groceries and you know it must last for two weeks, it forces you to think twice before you buy that extra item. A cash budget never lets you overspend because once the money is gone – it’s gone.

CASH ENVELOPE CATEGORIES

Getting started using the envelope system for budgeting is pretty simple. To begin, look at your budget. The following are cash envelope categories you should consider using:

- Groceries

- Clothing

- Dining Out

- Medicine

- Doctor/Dentist Visits

- Haircuts/ Beauty

- Random Spending (which you spend as you want – only if you can afford it)

You’ll notice that I didn’t include gasoline on my list. The reason I didn’t is that most people won’t overspend at the pump. Most of us just fill up our tanks and go about our merry way. You also don’t drive around and burn fuel or decide to fuel up because your neighbor did. It’s part of your budget but not an item where you will overspend. Not only that, it’s usually much more convenient to pay at the pump with a card.

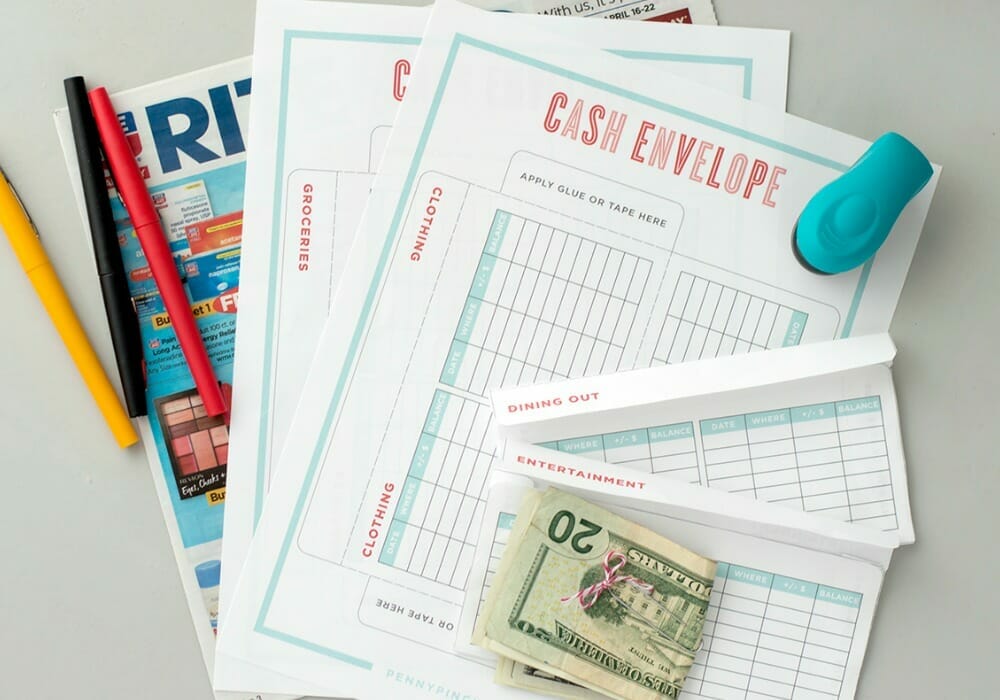

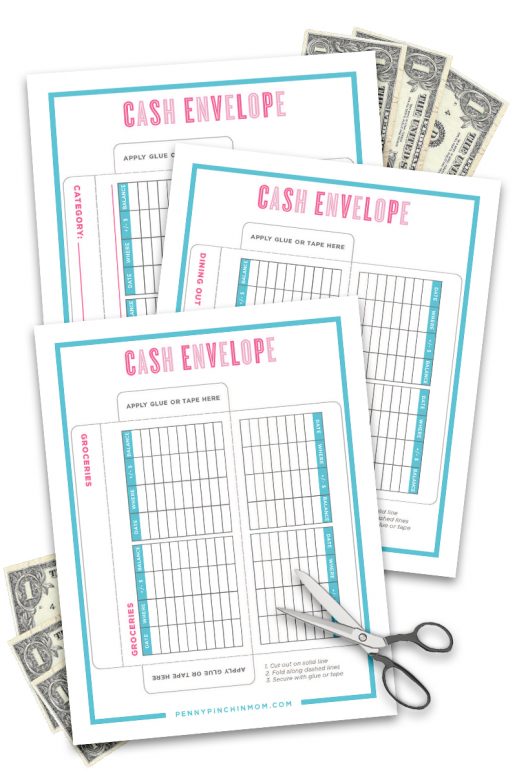

PRINTABLE DIY CASH ENVELOPE TEMPLATE

When it comes to using the cash envelope system, you can purchase one, such as the one sold by Dave Ramsey, or you can just use the envelopes in your desk drawer. I’ve got a cash envelope template you can download for free.

HOW MUCH CASH DO I NEED?

Once you have your categories, you have to determine how much cash you need for each envelope. You’ll figure the amount based on your pay period.

For example, if payday is every two weeks, take the total monthly grocery budgeted amount and divide it by two. You’ll then know how much money you’ll need for each of the two pay periods in that month. It’s important to have a budget that works (including using budget printables as needed).

Next, review each spending category you’ll use cash for, and figure out the amount you’ll need. Once you’ve done that, you’ll also want to figure out how many of each denomination of bill you’ll need. List the total amount, by denomination, on a piece of paper. Take that to the bank, along with a check from your bank account for the amount. You’ll make a withdrawal and then split up the cash into each envelope.

HOW TO USE THE DAVE RAMSEY ENVELOPE SYSTEM

Sometimes it’s easier to understand something if you can see it in action. Follow this simple cash budget example to see how it works.

START WITH YOUR REGULAR BUDGET

Let’s say you bring home $2,500 per month. You have completed your written budget and have items such as your mortgage, utilities, food, dining out, debts and other expenses. Many of your expenses are paid for with a check or electronic transfer. Those are not the categories to consider for your cash budget. Instead, look at the variable expenses you don’t pay for all at once – instead, you pay for them over time.

These are the items that will work best if you use cash. In this case, you’ll include groceries, clothing, dining out, random spending and doctor visits.

In this example, we will only use cash for these items.

MONTHLY BUDGET

Groceries – $500

Clothing – $100

Dining Out – $100

Random Spending – $80

Doctor – $50

DETERMINE HOW MUCH CASH YOU NEED PER PAYCHECK

As you can see, the budget above is based on your monthly income. If you’re paid every two weeks, that means your take-home pay is $1,250 twice a month. You only need enough money to cover half of each of these categories. Your spending for each will look like this for each pay period:

MONTHLY BUDGET DIVIDED FOR BIWEEKLY PAY

Groceries – $250

Clothing – $50

Dining Out – $50

Random Spending – $40

Doctor – $25

Total cash needed: $415 per pay period

Now that you see what you have budgeted to spend on each category each pay period, you need to determine how many bills of each denomination you’ll need to get from the bank.

KNOWING HOW MUCH CASH YOU NEED FOR A CASH SYSTEM

Using the same cash budget example above, here’s how you’ll do that:

Groceries – $250: three $50 bills, five $20 bills

Clothing – $50: two $20 bills, one $10 bill

Dining Out – $50: two $20 bills, one $10 bill

Random Spending – $40: two $20 bills

Doctor – $25: one $20 bill, one $5 bill

You need to get this cash from the bank. You can’t use an ATM because it will spit out only $20s and $10s and will not give you the correct number of bills. Make a note to hand to the teller that shows how to break down the cash:

Three $50 bills

Twelve $20 bills

Two $10 bills

One $5 bill

Write a check for $415 payable to “Cash,” and take it, along with your slip of paper, to your bank. The teller will cash the check and give you the bills you need.

FILL YOUR CASH ENVELOPES

When you get home with your cash, it’s time to add the money to each envelope. Find the one for each spending category listed above. Pull the cash from the bank envelope and split it into each envelope, per the list above. Add the amount of the deposit to the front of the envelope, adding to any amount that may be left from the prior pay period.

USING THE CASH ENVELOPE SYSTEM

Once you have your cash and your envelopes, it’s time to put them to work. The only – and I mean only – way this will work is if you track Every. Single. Transaction. I am not joking. Doing this can help you stay on track, and you also have to account for everything you spend.

For example, shop as usual at the grocery store. If your total is $20.17, pay with cash from your groceries envelope. Place any cash you get back into the envelope, then deduct your purchase from the balance. So if you had $100 and spent $20.17, the total cash you have left will be $79.83.

The printable cash envelope template above includes lines on the envelope, so you have a place to track your balance. If you use your own, add it to the outside of each envelope or keep a slip of paper inside.

Make sure you track every purchase. You can always see where money was spent and how much money you have left. It helps you monitor your spending at a glance. Once the cash is gone, you’re done spending money in that category.

USING THE VIRTUAL CASH ENVELOPE SYSTEM

I also get that sometimes cash is just something you can’t do. You need (or just really prefer) using your debit or credit card instead. Is there a way you can apply this method when you spend using plastic?

Of course!

Rather than getting paper money to put into your envelopes, you can use either a virtual envelope or paper tracking to monitor your spending.

You can read more and get started with different ways to use the cash envelope method even if you don’t use cash.

HOW TO USE A CASH METHOD WHEN SHOPPING ONLINE

What if you don’t always shop in stores but rather do some of your shopping online? How would that work with a cash budget? Can you even do that? Yes, you can. You just have to handle it a little differently.

The first option is to leave in your account some of the money you normally get in cash. For example, if you spend $100 every paycheck through online purchases, get $100 less in cash. You can still account for it by using cashless envelopes. That way, you still monitor your spending and don’t blow your budget.

The other option is to still get all of the cash you normally need. Then if you buy something online, head to the bank and redeposit that amount into your account. You still get the full benefit of using cash and seeing the money come out of your envelopes.

You can use a cash envelope system when you shop online – you just have to make some adjustments.

WHY THE CASH ENVELOPE SYSTEM WORKS

The reason the cash envelope system works is pretty simple: accountability.

When you have to make yourself accountable for your spending, you’re taking control. It also will help you spend less. If you only have $100 to spend on dining out over the next two weeks, you’ll think twice about ordering takeout three days in a row. When the money is gone, you are done spending!!!

This isn’t entirely about cash. It’s also about learning financial self-control. That’s the one thing everyone will gain by going through this process. It enforces a way of thinking. You’ll quickly learn to love using cash, and you’ll feel more in control of your finances.

Cash also has more emotion attached to it. You don’t think about the consequences of a purchase when you swipe a card. However, handing over that cold, hard cash sometimes hurts. You do think about each purchase a bit more.

We’ve been doing this for so long that I don’t know how to shop without my envelopes! It’s routine, and it helps us always know, in a matter of minutes, how much money we have available for the things we need.