When you’re broke and money is tight, you can still budget your money. Honestly, you might actually be broke because you don’t know how to budget. No matter the situation, with a little effort and hard work, you can create a workable budget.

I know what it is like to barely make ends meet. In my 20s, I grew up with the mantra “too much month and not enough money.” It is terribly stressful! It makes managing your money extremely difficult. It can make you feel sick to your stomach when even considering making a budget.

The thing is that you need a budget. It doesn’t matter that you’re broke, how much you make or that you don’t have enough to really cover your bills. The difference is that the way you reflect your spending will look different.

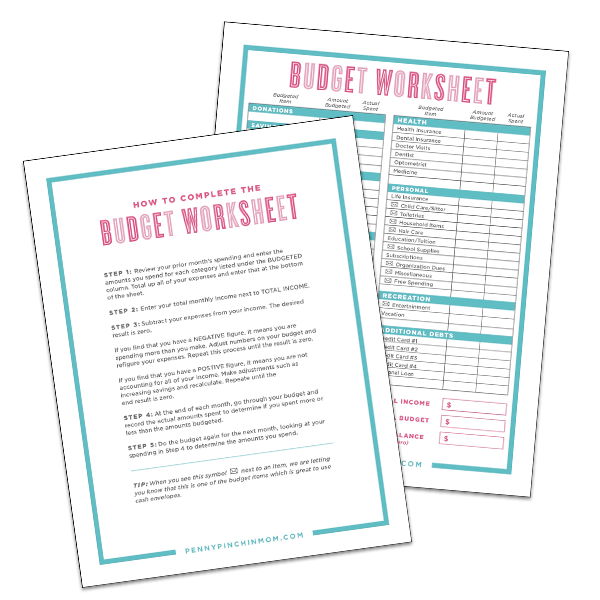

Free Budget Template

Before you start, download your free budget template (just watch your email for the details you need to log in and access the form).

Look at your financial situation

If you are spending more than you bring in then you have only two options available: make more or spend less. There is not any other way to look at it. While you might be able to find a new way to make money at home, that is not always an option for everyone.

No matter if you plan on making more money or not, you must make sure you really understand how things look financially. The best way to do this is to take a good look at both your income and your expenses. This will help you create a budget that will work for you.

Also see: How to budget money on low income

Check your expenses

The next thing you should do when you’re broke is to make a list of your expenses. You need to determine your needs and your wants. Your needs include:

- Housing (rent or mortgage)

- Utilities (water, sewer, trash, etc).

- Food (groceries only – no dining out)

- Personal products (shampoos, household items)

- Clothes

Anything else on your list falls under wants.

Reduce your wants

If you have no money, that means you can’t spend as much. Look at your wants to find the items you can reduce or even eliminate completely from your budget. These might include:

- Cable (reduce or eliminate completely)

- Internet (maybe get a smaller plan with less data)

- Cell phone (maybe go with pre-paid if your contract is up)

- Dinners out (change where you eat or eliminate)

- Entertainment (check out free options, or reduce your spending)

- Subscriptions (cancel those you do not need)

- Memberships (end your gym membership and create your own workout routine)

While you may not be able to change all these, perhaps one or two of them jump out to help you come up with an idea of what you might be able to eliminate from your budget.

Pay less for your needs

Now that you found a few wants where you can either cut back or eliminate spending on your want, you will want to look at your needs. There are ways you might be able to cut back. Some ideas:

- Change where you shop. Around here, we have Aldi, which has great food at amazingly low prices. Perhaps there is a store where you can purchase your groceries at a lower cost.

- Can you move or reduce rent? I know this is extreme, but if you really can’t cover rent and your other expenses, maybe you could find a different place to live. Maybe you could find a roommate. While extreme, you may need to temporarily move in with family.You might even try to negotiate rent. Perhaps you can offer services that the landlord needs. If he pays someone to mow your yard, maybe you could offer to do that yourself in return for reduced rent. Talk to your leasing agent about ideas as you never know what might be an option.

- Refinance your mortgage. Look at your interest rate to see if you could get a lower rate. Visit with a mortgage lender about whether it would be good for you to do this, as you might be able to lower your monthly payment.

- Budget billing. Some utility companies allow you to pay flat amounts towards your utilities every month. This helps keep your budget easier to manage as you don’t have those high summer bills when you run your air conditioner or huge gas bills come winter. It can make your budget easier to manage.

- Negotiate your utilities. Believe it or not, it is possible to do this, but the problem runs in trying to know what to say and how to say it. One way you might be able to do this (which is free for you to use) is a site like BillCutterz.

Tackle your debt

Just imagine how different your budget would look if you did not have the debt to deal with. Make a list of your debts and then decide how you want to pay them down. The Debt Snowball Method is a simple way to start.

Start by paying any additional money to the debt you owe the least to and when it is paid in full, roll that payment and additional money into the monthly payment for the next debt on your list. Continue until you have no more debt.

Reach out to your creditors

If your financial situation has worsened greatly, your creditors may be willing to help. Call them and explain your situation. It may result in lower money payments or reduced rates.

Write down your budget

Your written budget needs to account for every cent. To begin, fill out your budget by listing your income at the top. Beneath that, list out every single need from your list above, as well as the monthly amount you pay to each. Once your needs are listed, add in your wants. If the balance shows you are still spending more than you bring in, you’ll have to make changes.

Adjust the amount you pay to each, but make sure you are realistic. For example, don’t try to live on $50 a week at the grocery store if that is impossible. Doing this just sets your budget up for instant failure.

Make sure you still budget for a bit of fun for yourself. If you eliminate absolutely everything you enjoy, you will come to resent your budget and not follow it at all. Instead, give yourself a small amount you can spend on what you want and you’ll be more likely to follow your budget.

MAKE SOME TOUGH DECISIONS

Look at your budget. Are you still coming up short? If so, it may be time to make very tough decisions. You may need to pay your water bill late this month so that you can keep the lights on. Or, perhaps you pay the mortgage a few days late.

Look at the bills to determine which, if any, have the least penalty associated with them. You might take a hit on your credit if you pay your mortgage late, but that $20 penalty may be a better risk than having the lights turned off.

There are many things you can do if you can’t pay your bills. The key is communication with the people whom you owe. Make sure you also check with local agencies who offer to help pay bills when money is tight.

While it is not impossible to create a budget if you have little income, you can do it. You just need to do approach it differently than you would if your financial situation were not as bleak. This is not fun. It is not easy. However, it is the first step in gaining financial control.