It is no secret that you need a budget. But, it is imperative that it includes everything. Take the time to review your spending and don’t leave anything off of it. Below you will find a list of household budget categories you need to include. Forgetting even one off might be a big mistake.

It is no secret that the number one thing you must do to take control of your finances is to create a budget. Without one, you really can’t see where your money goes. Or, more importantly, you don’t get to direct your money to be spent as you would like for it to be!

While there are posts on how to create a budget, one question I get frequently is, “What categories should I include in a budget?” When you are new to making a budget, something such as a personal budget categories list can help. I agree.

As you create yours for the first time, it is important you don’t leave off anything important. A successful budget is one that includes a line item for every way you spend your money.

If you are just learning about budgeting, you will want to check out our page — How to Budget.

There, you will learn everything you want to know about budgets and budgeting.

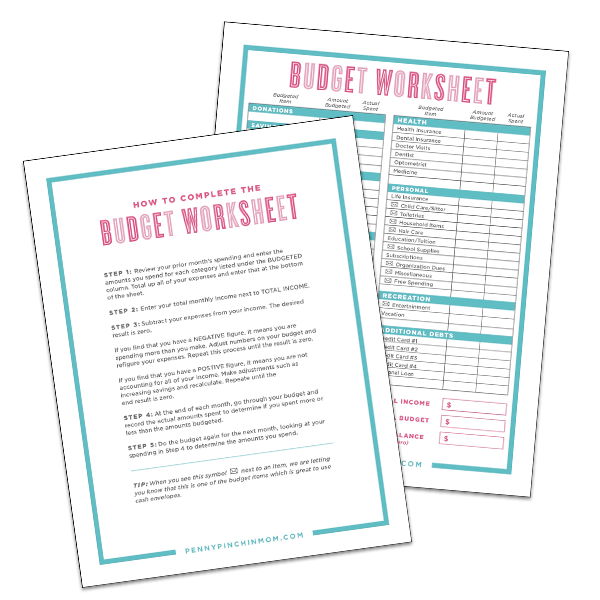

To help you get a jump start on with your budget, and to make sure you don’t leave off any categories, download our free budget template. This form has helped thousands get started with creating a budget.

SIMPLE BUDGET CATEGORIES

Once you have your form, you are ready to figure out your budget categories! While you may not have each of these as individual line items on your form, just make sure you include them all somewhere in your budget!

DONATIONS OR CHARITY CATEGORIES

These are all of the monthly donations you make to various charities. Don’t forget about those you may make only once or twice a year as well!

Church

Medical Research

Youth Groups

SAVINGS CATEGORIES

While not needed to live, it is crucial that you always pay yourself before you pay anyone else. Once you meet your necessary expenses, ensure you are saving enough each month.

If you are in your employer’s retirement plan, you pay those before you get your paycheck, so you would not include them. However, make sure you account for the different types of savings accounts you may have.

Emergency Fund Savings

Annual Fees, such as taxes, insurance, and dues

College Savings

Investments

Christmas/Birthdays/Anniversaries

Additional Retirement (outside of your employer’s plan)

Read More: Yearly Savings Challenge

CATEGORIES FOR HOUSING

No one will forget to add housing to their budget. But, make sure you include the amount you may save for repairs and other expenses. To figure out how much to budget, look over your prior year spending and divide that total by 12. You will add this to your savings, but you can track it under your housing budget category.

First Mortgage

Second Mortgage (if applicable)

Property Taxes

Insurance

Home Owner’s Association Dues

Maintenance

Housekeeper/Cleaning

Lawn Care

PERSONAL BUDGET UTILITIES CATEGORIES

You can’t live without your water and electricity. It is essential that you don’t leave any of these off of your budget either! These are some of the basic budget categories most people will not intend to forget, but just might.

Electricity

Water

Gas/Oil

Sewer

Trash

Cable/Satellite/Streaming Services

Internet (if not part of your cable bill)

Phone

Read more: How to Lower Your Utility Bills

FOOD

You have to eat. There are only two ways that happens — you cook or you eat out. Make sure you include both of these categories in your budget.

Groceries

Dining Out

TRANSPORTATION CATEGORIES

You have to be able to get around. That doesn’t always mean a vehicle as it could mean using other means of transportation. Whatever method you use, make sure you include all of those expenses in your budget.

Remember that you may not have to pay for some of these items each month, but it is essential you budget for them monthly so that the funds are available when needed.

Vehicle payment (make sure you include all payments for all vehicles)

Fuel

Insurance

Taxes

Tags/Licensing

Maintenance

Parking Fees

Taxi/Bus Fares

CLOTHING

A line item many people leave off of their budget is clothing. They forget that it is a necessary expense. While this doesn’t mean you should go and buy new clothes all of the time, it does allow you to replace items which are worn out.

It is also essential that parents include this item as kids need clothes a bit more frequently.

Adult Clothing

Kids Clothing

CATEGORIES FOR HEALTH

Don’t forget your health expenses when determining a budget. Make sure you include the money you pay towards your co-pays during the year.

Health Insurance

Dental Insurance

Eye Insurance

Doctor Visits

Dental Visits

Optometrist

Medications

Deductible Savings

PERSONAL ITEMS CATEGORIES

Personal is a “catch-all” category which may contain much of your discretionary spending! Some of the most common types you need to include:

Haircuts/Manicures/Pedicures

Life Insurance

Child Care/Babysitting

Toiletries (if not included in your grocery budget above)

Household Items (if you did not already include in your groceries budget above)

Education/Tuition

Dry Cleaning/Laundry

School Dues/Supplies

Magazines

Gym Memberships

Organization Dues

Postage

Pet Care (food, grooming, shots, boarding)

Photos (school and family photos)

Random Spending (always useful as a way to pay for the things you may not have broken out in your budget)

RECREATION

We all love to spend some time doing things we love. Don’t forget to include your entertainment category when determining your budget.

Entertainment (movies/concerts)

Crafts

Hobbies

Parties

Vacations

DEBTS

Once you pay off your debt, these will go away entirely and will no longer be needed. You can learn how to get out of debt and get started with that (once you have your budget).

Credit Cards (all debt)

Unsecured loans

Home equity loans

Student loans

Medical loans

Now you have the categories you need for your budget! Take the first step in getting control of your finances by putting this to work for you.