As we begin a new year, one of the most common resolutions that people make is Save More – Spend Less. In fact, this is always one of the top five resolutions made each and every year!

This can be easier said than done. If you have never really done this before, it can be challenging to know where to start. The first step is always to create a budget. The budget is your roadmap (read more about How to Create a Budget).

I’m not going to go back through budgeting again, you can click the link to read more about that. Let’s talk about savings. Actual, concrete, “cash in hand” savings. It can be overwhelming to know how much to save, how often or what you will have saved at the end of the year.

As with many things concerning finances, there is not just one method of achieving your savings goals (well – except for – DON’T SPEND MONEY). The manner in which you save and how you get there is what differs for every single person. I know that what works for one person will never work for another.

That is why I’ve created not one, not even two but THREE different ideas for saving at least $1,000 this year! Not only that, but I’ve even got a FREE PRINTABLE that you can download right now and get started as soon as possible. To make it better – I’ve created sheets that your KIDS can use too!!!

Even if you don’t start the first week of January, you can either make additional deposits to get caught up or even just start your weekly savings journey as soon as you can.

WEEKLY INCREASE METHOD

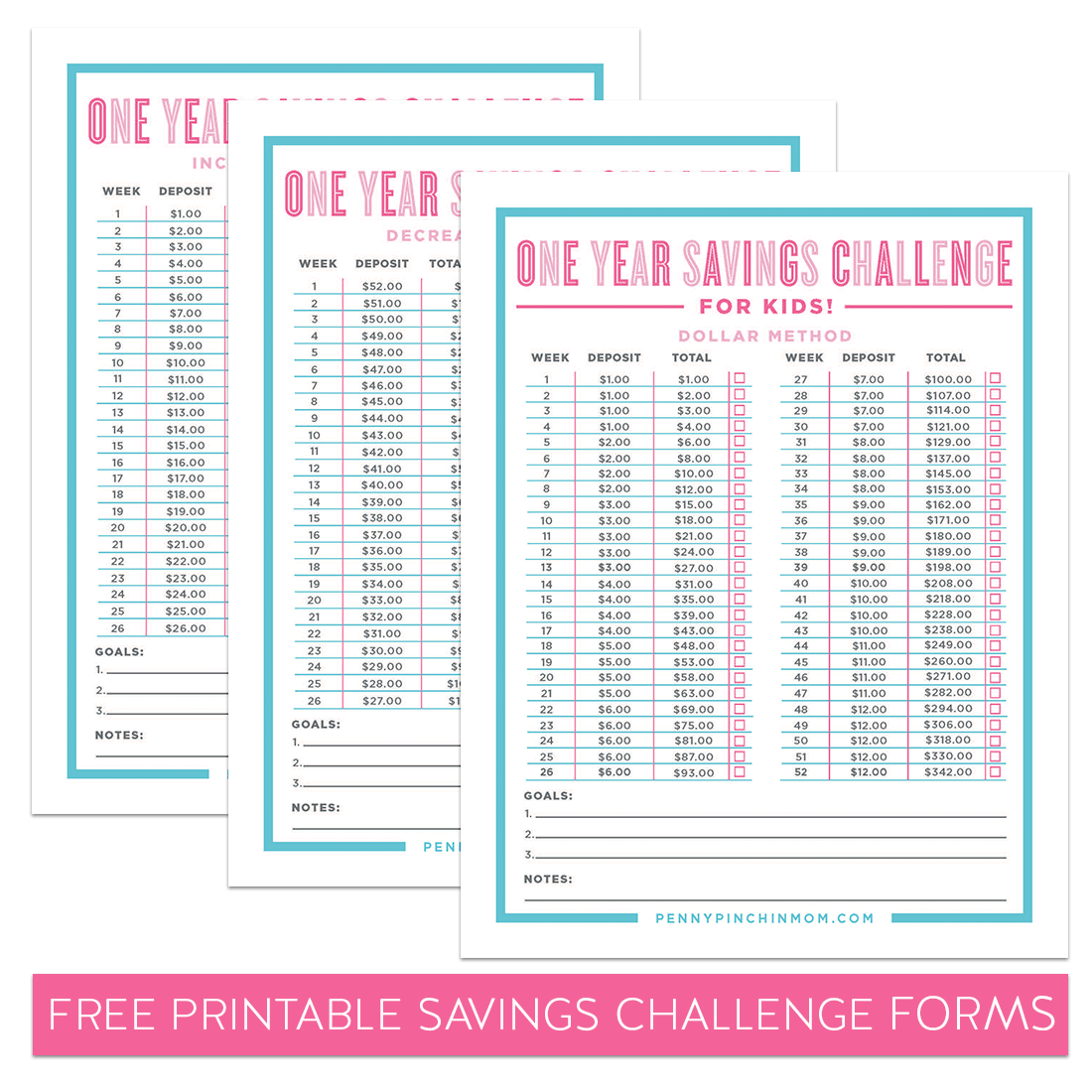

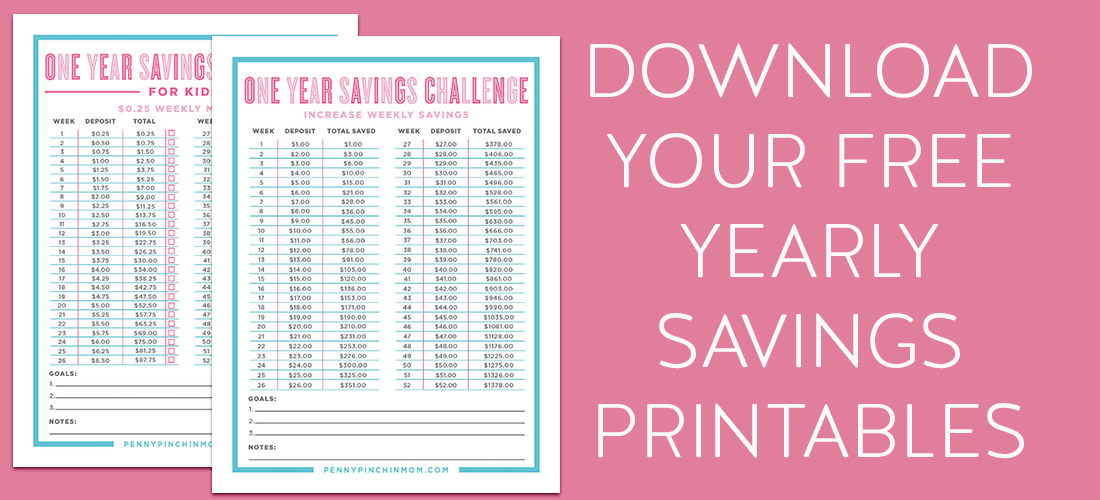

You can do your yearly savings plan by increasing the savings each week. Just save $1.00 the first week and add another dollar each week. If you stick with it, you will save $1,300 by the end of the year.

WEEKLY DECREASE METHOD

The decrease method is like the increase method – but in reverse. The first week you will save $52, the second week $51 and so on. That way, as you get closer to the end of the year when you typically spend more money, you aren’t obligated to save as much. The weekly decrease method will also build $1,300 over a year.

UP AND DOWN METHOD

If the idea of saving $50 is a bit too much, then the up and down savings method might be a better option. The great thing about it is that you will never have to save more than $35 in any week during the year. However, it is not just cut and dry as to what to save. You will start out making deposits in dollar increments until you reach $10. Then, you will increase in $5 increments — but will repeat the same amounts for various weeks during the year.

When you reach week 31, you will actually decrease your savings by $5 and continue along with that same idea (following the schedule) until such time as you reach the end of the year. This method will save you exactly $1,000 by the end of the year.

KIDS CAN DO THE WEEKLY SAVINGS CHALLENGE TOO!!!!

It is important to teach kids important financial lessons at a young age. While they don’t make as much as mom and dad do, they do often receive an allowance (or commission as we call them in our house).

By laying the foundation of how to save, your kids will do this on a regular basis as they grow older. They learn those habits at a young age and often carry them into adulthood. There is no greater gift you can give your child but to set them up on the path to success, even at a young age.

As with the adult savings methods, we also know children earn different amounts of money. That is why we also have three different savings methods for them as well!

THE $0.25 WEEKLY METHOD

Rather than saving $1.00 and increasing by $1.00 week after week, kids follow the same method but with an amount they can afford. Children start at $0.25 and add another $0.25 every week. It’s a great way to get them started saving and before they know it, they will have more than $200 saved!

DOLLAR METHOD

If your kids earn a bit more money the dollar method may be more appealing. They deposit the same amount every week for 4 weeks, before the increase the savings to another dollar. There are 4 times when they will make the same deposit for 4 weeks (or they could add another 4 weeks of saving a higher amount). If they follow this guide, they will have saved close to $350 for the year!!!!

DOLLAR + $0.50 METHOD

You can also combine the ideas of both of the kid’s savings charts. Your child will start with $1.00 and deposit that same amount for 4 weeks. Then, he or she will increase the deposit by $0.50 for the next four weeks. The most they will ever have to save in any given week will be $7 (towards the end of the year). Following this method will result in $208 savings over the course of a year.

It Doesn’t Matter How You Do It – Just Save!

There is no right or wrong way to do it. Just commit to saving and you will be pleased with the results. Best of all, you can use that money towards any goal! I recommend you write that on your own challenge form.

Post your sheet where you can see it. You want to see the reason you are doing it be it a trip, 100% cash for the holidays, new furniture — whatever you are saving for.

Then, imagine, come January 1st of the following year being able to see that you did it! You really did save and were able to reach that amazing goal.