Becoming debt free takes a lot of hard work and dedication. Before you can actually begin paying those debts down, you need to make sure you have created your budget, debt paydown and emergency fund.

Once those tasks are completed, you are ready for the fun part — actually paying down debts! Of course, if you are already debt free and are working on building your savings, just apply these same principles to your savings account. Instead of paying the debtor, pay yourself!

DEBT PAYDOWN

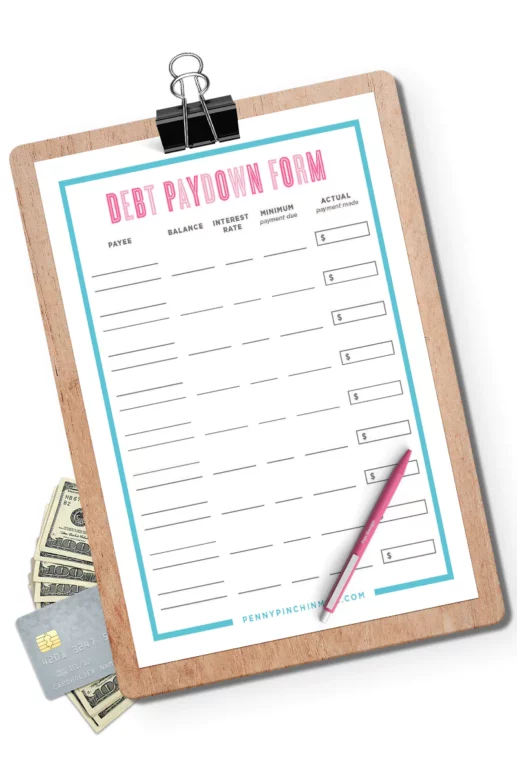

Watching your debts slowly disappear is so much fun! However, it is important that you are ready for this step. First, make sure you have completed your paydown form correctly. This form should list all of the debts you owe, listed from the lowest balances to the highest. You should also have your budget, where you list each debtor and the amount of the minimum monthly payment you need to make. Got that? Good!

Now, take a look at your budget. Do you have any ‘extra’ money you have freed up towards paying down your debts? If you do, then look at your Debt Paydown form to find out who you owe the least amount of money to. Then, go into your budget and increase the monthly payment to them by the amount of the “extra” money showing in your budget. Here’s an example:

Citibank – owe $500 – monthly payment of $10

Visa — owe $885 — monthly payment of $15

Auto Loan — owe $12,500 — monthly payment of $425

Let’s say that you show “extra” money in your budget in the amount of $25. Your budget will then look like this:

Citibank – owe $500 – monthly payment of $35

Visa — owe $885 — monthly payment of $15

Auto Loan — owe $12,500 — monthly payment of $425

This means you will pay $35 each and every month to Citibank until it is paid off. You will not pay anything above the required minimum payment to any other debtors. Then, when Citibank is paid off, you will roll that payment into Visa – which means you will pay the $50 per month. You will continue to do this as you eliminate each debt, increasing your monthly payment – just like a snowball!

WAYS TO ELIMINATE DEBT

I previously shared some ways to help you eliminate your debt (outside of your monthly payments). As a reminder, here are some ideas:

- Sell items on Craiglist, Ebay or other methods. If you have extra things lying around the house, you may wish to sell them and raise some money and then turn around and make a nice big payment on that smallest debt.

-

Get another job. If you can swing it, pick up a part time job and apply all of your earnings towards your debt.

-

Reduce savings and pay down debts. If you happen to currently have MORE than $1,000 in the bank, but still have debts, you should really take any amounts above $1,000 and pay down your debts BEFORE you are saving. The reason is why are you saving money for yourself and paying more in interest to someone else than you are making yourself?

So, what about that nice big tax return that is coming your way in a few weeks? Well, if you really want to jump start your debt elimination, you would be wise to deposit $1,000 into the bank (if you do not yet have your emergency fund) and then turn around and use the remainder and pay down your debts!

Now that you have your budget and are starting to actually pay down your debts, you are on the right path!

(I am not a financial advisor and the information listed within these posts is not to be construed a financial advice. Financial concerns/issues should be addressed with a professional in order to receive advice and assistance.)