I am proud of many things I’ve done in my lifetime (with my kids and husband topping the list). Another thing I’ve done is paid down more than $37,000 in debt and fully funded our 6-month emergency fund. Not having debts looming over our heads has afforded us many more opportunities — the best of which is just freedom from debt!

Like so many others, my husband and I were not as savvy with our finances as should have been. As a result, we had quite a bit of debt and often, we would find ourselves living paycheck to paycheck. In November 2007, we found the answer to our problems. We read Dave Ramsey’s Total Money Makeover.

It might sound cliche, but it really was life changing for us. For the first time in both of our adult lives, our financial life was more secure. Not only that, my husband and I have grown closer and our marriage is stronger as a result (which was a benefit neither of us ever expected, but are so grateful for).

If you find yourself wandering down the same path of financial mayhem and are ready to commit to making a change, then you will want to read further to learn how you can get out of debt! Are you ready? Because there is no time like right now to get started on working your way out of debt.

Of course, we can’t just jump in and start to pay off those bills. There are some steps you should take in order to get a true picture of your finances. Trust me when I say that I KNOW this will be difficult. However, you will need to do this in order to fully commit to getting out of debt.

WHAT TO DO WHEN YOU WANT TO GET OUT OF DEBT

NET WORTH

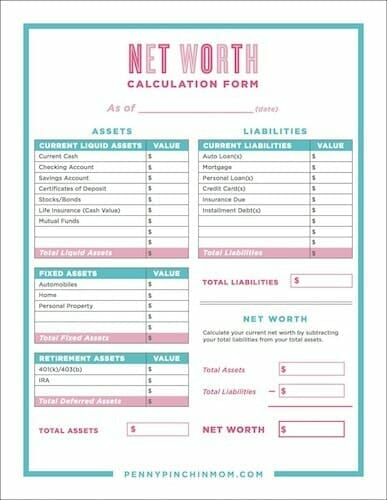

The first thing you must do in order to get out of debt is to determine your Net Worth. This provides you with an overview of your assets and liabilities and gives you an overall picture of what you ….well….are worth (financially only, of course). If, when you prepare yours you find you are in the red – or have a negative net worth — remember that is is OK!!! This is part of the journey to financial independence.

The way you can determine your net worth is to add up all of your assets and then subtract your liabilities. You can just do this on notebook paper or in a spreadsheet. You can get your own Net Worth Form by clicking on the image below.

If, when you prepare yours you find you are in the red (or have a negative net worth), that is OK. This is part of the journey to financial independence. You are working to turn this around and end up with a positive net worth!

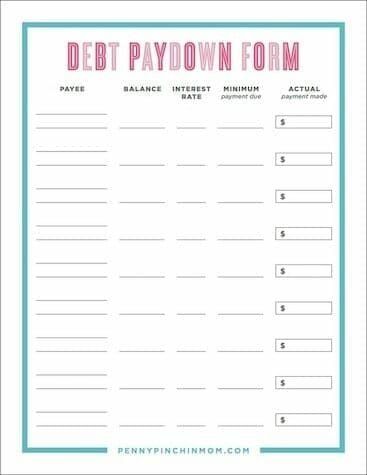

DEBT PAYDOWN FORM

At this time, you will prepare another form as well. This one is entitled The Debt Pay Down. This one should be simple as it will stem from the liabilities you will record on your Net Worth Worksheet. Get a debt paydown form by clicking on the image below.

Find all of your debts. List the one you owe the least amount to first. Include the balance due as well as the minimum required monthly payments. Continue to do this and list all of your debts in this same order. The method my husband and I used meant to pay down lowest balances first and not consider interest rates. However, you can list your debts in that manner instead (read more about paying down balances or interest rates first).

Also see: Which debt to pay off first

That is the very FIRST step in getting out of debt! The next thing you’ll do is create a budget! You can then continue with the other steps on how to get out of debt as listed here.