The easy step-by-step instructions to learn how to create a budget – that works!

Far too often, I hear people asking if really need a budget. Whether you are in debt or not, it is imperative that you have a budget. Without one, your money tells you where it wants to go rather than you controlling how you spend it.

Budget.

I know that this is the other “B” word out there. However, without a budget, you have absolutely no control over your finances. This is one of the key tools required to work yourself out of debt and achieve financial freedom.

Before my husband could dig ourselves out from debt, we had what we called a budget. The truth is that it was not a budget at all. It was a piece of paper with the list of the people we had to pay every month. It was not a true budget.

When we began our debt free journey, I had a difficult time creating a budge. It made me sick to my stomach to see it all written down on paper. The reality was that when our bills were all paid, we had nothing left over. Nothing for food. No money for anything at all.

But, as we started to pay off our debt, we began to see a change in our budget. We were able to remove debtors from our budget and eventually added in categories like dinner out, vacation, movies, and even SAVINGS.

When you have a budget, you are taking charge of telling your money where it needs to go rather than it telling you where it wants to go.

[clickToTweet tweet=”When you have a budget, you tell your money where it should go instead of the other way around.” quote=”When you have a budget, you tell your money where it should go instead of the other way around.”]

WHY DO I NEED A BUDGET?

This is a question that many people have asked me over the years. Allow me to turn that around.

Why is it that you think you don’t need one? Do you think you don’t need to remember which bills need to be paid? Perhaps you think that you don’t need to remember to plan for annual or unexpected expenses? Even if you feel you don’t need a budget, the truth is you do. Everyone does.

A budget helps you know where your goes. It can help you ensure you are saving enough and paying down your debts. Your budget can help you control your spending.

Simply put – a budget helps you gain financial control. We all know we can’t control a lot of things in our lives, so it is nice to know there is something we can!

Even if you don’t have debt and are financial stable, you still need a budget so you can just monitor your spending and make your money work for you rather than against you.

WHERE DO I START?

If you have never had a budget before, you may not even know where to begin. It can really be scary and overwhelming to get started. I’ll break it down for you into simple steps so that you can get yours set up and working for you.

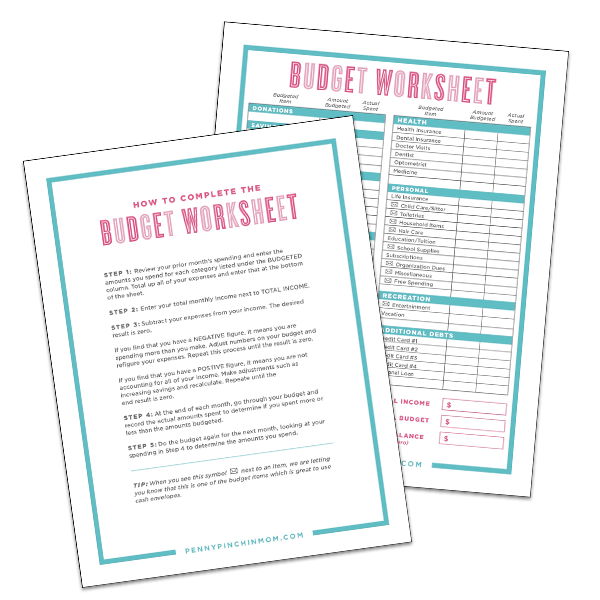

1. BUDGET FORM

First, you need a budget form. I have created a budget template for you to use — free of charge! You can either download the form, or use the spreadsheet version.

If you want something high tech, I’d recommend You Need A Budget (YNAB). You can try it for free for 34 days and then it is $60. It is worth every penny (and a one-time fee! However, I don’t pay for most apps or software I personally use as there is so much out there that is FREE!!!

2. INCOME

Next, look at your paycheck(s) – what we call your Income Source(s). Since your budget is based upon your monthly income, you will have to possibly complete some calculations to reach that figure. Here are some calculations to help you:

- Paid Bi-Weekly (i.e. every other Friday): Take the 4 income totals and subtotal them. Divide them by 2 and you will read your average monthly income.

- Paid Monthly: If the amount listed in each pay period is the same, you can just use the monthly income you see. Otherwise, add 3 or 4 months of income and divide by that same number of months calculated.

- Paid Weekly: Take the total of the 4 income periods and that will give you an average monthly income.

- Hourly or Commission Based (i.e. fluctuating income): Total your last 4 months of income and divide by 4 to reach an average. However, since your income fluctuates more frequently, you will need to adjust your income and revisit your budget more frequently.

3. EXPENSES

The next step in your budget is to determine your expenses. To ensure an accurate budget, you will handle your fixed expenses differently than discretionary.

Your fixed expenses include items such as your mortgage, car payment, insurance, etc. The things you pay every month which do not change (or only vary in payment slightly).

Your discretionary expenses include those which are not always the same payment (like your mortgage or cell phone bill). To get an accurate number for your budget, I recommend you create a spending plan. This will look at your spending over a period so that your budget reflects the amount you spend.

For example, if you spend $500 on food in month one, $600 in month 2 and $575 in month three, the three-month average would be $558.33. That is the amount you will add to your budget.

Look at your budget form to ensure you did not overlook any items you need to include. While we have included most that should be considered, check out this list of the categories you need to include in your budget.

4. FILL OUT YOUR BUDGET

This is the “fun” part. Transfer the amounts you have listed above into each spot on the budget. Your monthly income should go at the top and then the amounts for each expense in the appropriate location. Those listed on the form are to be used as a guide (reminder if you will) to ensure you properly account for all of your expense. You can add rows / edit the descriptions as needed.

Subtotal both the income and expenses. If you see that you are spending more than you take home, then you are short on income and will need to adjust your expenses. If you are not spending all you make, then you might consider increasing your savings or retirement account contributions.

If you would rather, you can watch a short tutorial video which explains how to complete the form. (Click here for larger screen version, if necessary).

WIPE YOUR TEARS AND LET’S MAKE SOME CHANGES

Yes, tears are common at this point. In fact, when I saw our budget for the very first time, I cried. I was sick to my stomach. I could not believe that we were in such horrible shape financially. However, the tears were quickly wiped away and my husband and I tackled our budget and started to rework the numbers and I started to feel better. I felt like I could do it. It would be tough, but nothing in life worth having is ever easy!

What we had to do was just really look at where we were spending our money. The first thing that had to go was dining out. Did we need to dine out every single week? No. We wanted to get out of debt, so we wanted to free up extra income to apply towards our debt. That was far more important than dinner out. Eliminating that expense immediately freed up more money which we could apply towards other mandatory expenses.

Just take a long, hard look at where you are spending your money. Even if you are not trying to work yourself out of debt like we were, you might see that you are spending more than you are making. You will need to eliminate some of your expenses. The simplest way to do this is to make two lists: Mandatory and Discretionary. Go through each item and indicate if it is a mandatory expense or discretionary.

Look at your mandatory expenses – like cable. If you get a high-end package, you might want to scale back to basic cable to get your budget to work (or even do this and free up income to pay down your debts). You might be like us and find you spend a lot of money dining out and can save a lot of money that way as well.

Then, look at your discretionary spending. Are you paying $50 a month for a yoga class that you go to only now and again? What about your subscription to that magazine that sets you back $75 a year? These are luxuries. They will have to go.

If you are spending more than you make or are trying to pay down your debt, you can’t afford anything but what it takes to keep a roof over your head, the lights on and food in your family’s stomachs (so to speak). Trim that budget down to bare bones and you might be surprised to find that extra $100 – $300 or so hiding that you can now start to use towards your debt elimination, or to help put food on the table.

If, once you have adjusted your budget it still doesn’t look right, make more adjustments. If you have already scaled back on everything and it isn’t balancing out, make some calls to your debtors. Ask for reduced interest rates or how to reduce your payments. You can also suggest to them a different monthly payment other than the one they are asking you for. You never know what they will accept if you don’t make that phone call.

You are going to have to make tough choices/changes to your budget to make it work. As I said, one that we did was dining out. We ate out only about 10 – 20 times for a period of 2 years (unless someone else took us out to eat). Was it hard – Darn Skippy it was!! Was it worth it? More than you can imagine.

I HAVE MY BUDGET – NOW WHAT?

Once your budget is created, does that mean you are done? Sorry, but the answer is no. You will need to revisit your budget at least once per month to make any necessary adjustments. For most there will not be any to be made, but for some, things will happen to cause your line items to need to be adjusted. That might mean you will remove something (once you pay down a debt) or may need to add one (saving for that new vehicle).

Budgets are not easy nor are they fun, but once you have one set up and continue to refer to it, it will work. You will find it helps as you are now telling your money where you want it to go rather than it telling you where it is going to end up each month. Financial control – such an amazing feeling!

Check out our FINANCE section on the site for more budgeting, debt reduction and money saving tips and helpful ideas.