Online banking is the way millions of people handle their personal finances. However, the one tool that banks do not offer is a way to manage your money, such as an app. Sure, they show you what your accounts look like and the transactions but not the detail you want. CountAbout allows you to do this in a way that makes sense.

My husband and I have used Quicken for more than ten years. We use it not only because it works but also because it is easy to use. We were comfortable with it.

As great as that is, the downside is that Quicken was on our computer — but not on our phones. The fact is that we all rely on our phones for more than sending texts and getting calls. They are often our entire lives – including our finances.

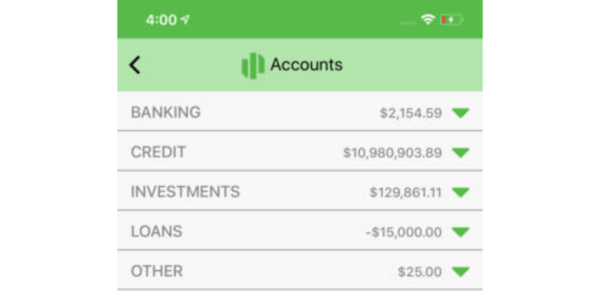

We have access to our bank and can check that balance at any time. However, if payments have been scheduled, but not yet deducted, we don’t see that. However, we do when we are on Quicken. We get a much more accurate picture of how much money is in our accounts at any given moment.

We had to find a way to check our balances (accurately) when we were not at home. When we learned about CountAbout, we decided to give it a try.

WHAT IS COUNTABOUT?

CountAbout® is an on-line personal app. You don’t need to download anything to your computer. If you have an internet connection then you can access and use Countabout.

WHY IS COUNTABOUT BETTER THAN QUICKEN OR MINT?

As I stated above, Quicken is a download on your computer. There is no way to access your statements if you are not at home. They don’t have an app or way to connect that data.

In fact, CountAbout is the ONLY app that allows you to import from Quicken or Mint.

IS IT SAFE TO USE?

That is a common concern many people have when it comes to using any apps that include personal and financial data (and with good reason).

First off, the only personal information they collect from you is an email address. They do not get your social, date of birth, driver’s license — not any of that information is necessary. And they keep that protected. They don’t sell or provide it to anyone.

While they will need to use your login credentials to access your account, that data is not stored anywhere on their servers. When you link to your bank or financial institution through CountAbout, they use a data aggregator called MX. That accesses your login credentials at your financial institution and establishes a link to CountAbout. They never see that information and they could never access it – even if they wanted to!

Everything entered or downloaded into CountAbout is encrypted. If they were ever breached, they would have no access to your information.

HOW DOES IT WORK?

I was shocked at how easy it was to use CountAbout. Once I set up the account, I followed their instructions to get my data moved from Quicken over to their system. (Seriously easy). Once that was done, I connected to our bank and downloaded those transactions.

One really unique feature you will find on CountAbout that is not on Quicken is that even pending transactions post. That means if you use your debit card to fill your vehicle with fuel, CountAbout will show that with minutes of your purchase. Quick does not.

Once it is set up, you can establish a budget and your categories. You can run various reports – including comparing your spending to your budget! It allows you to get a better understanding of your spending (and your saving).

PROS OF USING COUNTABOUT

I will admit that I was hesitant at first when it came to using something other than Quicken. I fear change but was pleasantly surprised! I liked that it was learning software. We changed categories as transactions were posted and as others came through to the same place, it knew exactly where how to tag it – not manual like it often is in Quicken.

Some other features we liked included:

- Setting up the custom spending and income tags and categories

- Reports to allow us to analyze our spending.

- The ability to upload receipts and images

- Automated downloading of our transactions

- Ease of use

It really lives up to what is promised (which is not always the case with many apps or services).

CONS OF USING COUNTABOUT

The only downside is that there are not any features for financial planning. However, that is not what most users are looking for when it comes to tracking their finances, so it is not a concern.

There is also no way to set up bill paying through the app. That would be nice, but I do that through my bank and so continued to do it that way. Maybe that will come in the future (one can always hope).

HOW MUCH DOES IT COST?

CountAbout offers a free 15-day trial period. That allows you to try it out before you go all in.

After that, you pay just $9.99 a year for the basic plan. This one functions like Quicken and you have to manually import transactions.

They also have a premium plan that does the automated download for you (which you will probably want). That fee is only $39.99 a year.

What I appreciate is that once the trial period is over, they do not automatically enroll you – you can decide which plan you want to use. Nothing is worse than signing up for a trial and forgetting until you see a charge come through on your statement!

Give CountAbout a try for free for 15 days. Just be ready to sign up when that ends – because you will love it THAT much!!