According to NerdWallet, the average credit card debt for the American Family is nearly $16,000. That is a considerable amount, and the monthly financial burdens can quickly become overwhelming

You may feel as if there is no light at the end of the tunnel as you see no end in site. How in the world did I let this happen and what can I do about it now?

You certainly do not want to be like me and go down the path of bankruptcy. Don’t do that.

Instead, you simply need to know where to turn for in order to get the help you need to pay off your credit card debt as quickly as possible.

The truth is that you may not even realize how much debt you have or where to begin. Let’s tackle your debt by helping you figure out the simplest way to get rid of your credit card debt as fast as possible.

HOW TO QUICKLY PAY OFF CREDIT CARDS

The first thing you have to do is take responsibility for it. Whether your debt is a result of severe financial times or frivolous spending, it doesn’t matter. But, before you even think about getting out from beneath your credit card debt, you need to be ready to make it happen. That means you have to be willing to put in the hard work and make the lifestyle changes necessary to achieve your goals.

Once you do that, you are ready to take steps to pay it off.

1. Transfer your balances to zero or lower balance cards

When you have a lot of credit card debt, you will want to try to lower the amount of interest you pay. Since that compounds every month, it can mean your $50 payment will only reduce the debt by $10.

Take some time to do some research to find zero interest rate transfer cards or those with a low introductory rate. If you can drop your interest payments, that will allow you to focus on paying off your credit card debts.

By consolidating your credit card debt onto one or two cards, you may find you save a significant amount of money in interest while working to pay off the balances.

2. Use your house

When mortgage rates are low, it might make sense to refinance your home. Doing so may allow you take out a loan large enough to cover the balance you owe on your home plus your total credit card debt, without increasing your monthly payment.

If you can borrow more money, you can use that additional amount to pay off your credit card debt. Then, all of your debt will be in one monthly payment – your mortgage.

Or, if you would rather not refinance, consider taking out a home equity loan. Use what you’ve paid towards your home to pay off your credit cards. The interest rate is often lower what your credit card company charges.

3. Use a personal loan to pay off credit card debt

If you do not own a home, talk to your bank about a personal loan (secured or unsecured). Just like a home equity loan, you can pay off your balances and have a single monthly payment, often at a lower rate than credit card companies charge.

4. Get rid of your cards

If you are committed to paying off your credit card balances cut them up. That way, you will not be tempted to add more debt to your balance. However, what you should not do is close the account. Keep it open and continue to pay on it to help increase your credit score.

For some people, cutting them is just not an option. If you find this is you, then you need to put your cards on ice. Literally. Put the card in a baggie filled with water and drop it into your freezer. Now, you won’t be tempted to dig it out and use it as you would have to put in a LOT of effort to do so.

Do what you have to do to stop spending. There is no way around this. Until you are ready to change your attitude towards spending money, you will not be able to get out of debt. This starts by cutting off the spending. Period.

Read more: How to Break the Cycle of Credit Card Debt

5. Know how much you owe

Sadly, most people have no idea how much credit card debt they have accrued. You have to know how much you owe before you can implement a plan to pay it off.

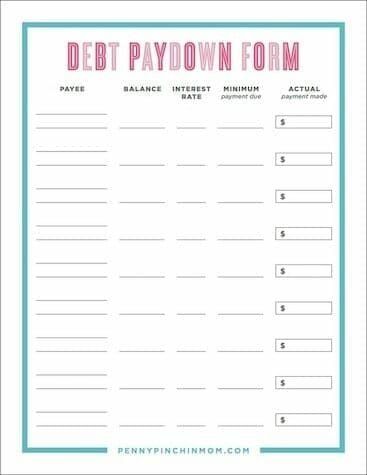

Make a list of the current balances owed, minimum monthly payment and the interest rate. Then add up total the amount of debt you have AND the total minimum monthly payments. This gives you a better picture of the amount of debt you currently have outstanding (and, it may not be pretty to look at).

The debt payoff bundle gives you every form you need to track, monitor and pay off your debt once and for all!!

6. Find money

Once you know how much debt you have to pay off, take a second look at your budget. Find places where you can cut back to have more money to pay your debt. That may mean scaling back or eliminating dinner out for a while, so you have another $100 to use towards your credit card balances.

Think about making some short-term sacrifices for long-term gain. You will not need to scale back forever. Once you are out of debt you may even find you don’t miss those items you cut out of the budget!

7. Start paying them down — One at a time

There are two different rules of thinking when it comes to paying off credit card debts. One says pay the higher interest rate, and the other says the highest balance. You can read more about those below.

No matter which method you decide to use, start with ONE debt and work on it first. Get it paid in full before you try to pay others.

You can use a debt payoff calculator to find out long it will take to pay off your credit cards and know how much you’ll save in interest along the way.

8. Consider debt consolidation

Sometimes, the best way out of debt is to consolidate them all into a single payment. You may find that you ultimately pay less over the life of the loan vs. what you would pay in interest on each card alone.

While credit card transfers are an option (as mentioned above) you may also want to try debt management or a consolidation program. These include counselors who may be able to negotiate (on your behalf) to reduce the rates or payment terms.

Rather than make the individual payments on each debt, you make a single payment each month to the agency. They then transfer the payment to the creditor on your behalf.

If you do not own a home or are unable to qualify for a credit card or personal loan then debt consolidation may be the answer.

HOW DO YOU PAY DOWN YOUR CREDIT CARD BALANCES

If you do not opt for one of the options above and instead want to tackle your balances on your own, there are two methods you can use.

Highest Interest Rate First (Avalanche Method)

The avalanche method of debt repayment starts by first tackling the debt with the highest interest rate. You will want to pay as much as you can towards this debt first, continuing with minimum payments on all other debts.

For example, if the minimum monthly balance is $25, try to double, if not triple, the payment. Combine this amount with any additional income freed up in your budget to pay towards your debt. Your focus should be only on this single debt until it is paid off. Continue making the minimum required payments on your other credit card balances.

Once your first card is paid off, roll the monthly payment you were making on that card onto the next card. So, if you were paying $150 on card one and $30 on card two each month, you will now pay $180 towards the balance of your credit card. Continue to do this until all of you are debt free.

Using this method results in paying less interest, therefore, less overall debt. As you tackle the one that accrues interest at a higher rate first, you will eventually pay out less to the company. The downside is that you may end up tackling an overall higher balance first, which can result in it taking longer to make progress, and you becoming discouraged.

Lowest Balance First (Snowball Method)

The snowball method does not take interest rate into account, but rather balances. Review your list of debts and find the one that has the lowest balance. This is the one you will focus on first.

You will follow the same rule as you would if you were paying down the higher interest rate card first. Find any additional money you can in your budget and add that to the minimum monthly payment of the lowest balance card. Continue paying on that card until it is paid in full. Once that happens, roll that payment into the next balance. Repeat this process until all debts are paid off.

The reason that this works is that it tends to be more encouraging. You will see that you are actually making progress as you can achieve a balance paid in full more quickly, which gives you the motivation to proceed. The downside of this method is that you may have to pay a bit more in overall debt due to additional interest on the cards.

The thing is that one of these is not “right or wrong.” I hate when I see so-called experts trying to degrade someone for trying one over the other. We are all different and we know what will motivate us to help us stay on track. Decide which of these two works best for you.

8. Use Windfalls

While you are working yourself out from beneath your mountain of debt, there may be times when extra money finds its way to you. You may get a raise or a bonus at work. This may be the year you qualify for a tax refund. When you get extra money of any amount, do not use it as you want. Instead, apply it towards your debt.

If you want to tackle this as quickly as possible, you may need to sell things you do not need or even get a second job. There are many ways you can make money at home, many of which will not interfere with your regular full-time job.

STAYING OUT OF CREDIT CARD DEBT

Once your credit card debt is paid in full, you never want to allow yourself to get into that situation again. Here are things you need to do:

1. Figure out why you got there in the first place

Was the reason you had debt due to poor saving? Are you a spender? Did you just not have a budget and had to use it to cover living expenses?

Whatever the reason, you need to make sure you know what lead you down that path, to begin with, and make changes in your life so that it doesn’t happen again.

2. Have an emergency fund

Many times, people turn to credit cards when they have an unexpected expense. This is where your emergency fund will come into play. Instead of turning to a credit card to bail you out, you will use your emergency fund balance instead.

Read more: How to Rapidly Build an Emergency Fund

3. Never charge more than you have in the bank

Far to often, people will charge in advance of a paycheck or other income source they plan on coming their way. But, what happens if that fails to come through? Can they pay off the balance?

If you can not pay off your balance with the money in your checking or savings account, then do not charge it. Just because you are owed money does not mean it will come through.

4. Always pay balances in full every month

It can be tempting not to pay off your card and keep more of the money for yourself. However, this will just put you back into the same situation you just got out from. Make sure your entire balance is paid off every single month. No exceptions.

5. Review the perks

Many people use credit cards because of the perks. These include cash back, free offers or even airline miles. However, what do you have to spend to earn the reward? Is it worth racking up a hefty balance just to get something free?

Companies can change their programs at any time. You could lose those you’ve earned or no longer be eligible to earn new ones. The perks may sound great, but are they really worth it?

Trying to pay off credit card debt is not easy. However, can you continue to live with the financial strain they are causing you? Only you can decide that it is the right time to pay off credit card debt.