Trying to spend less and save more money? These are the tricks I have used and the best part of all is that they really work!

It is simple to make a resolution, but the trick is finding ways to actually keep it and make it happen. This week, we will share our tips on how to make the top five resolutions work for you. We will even share tips to make any change in your lifestyle actually work well (in case your idea is not listed here).

The number 5 resolution was: Spend Less, Save More. This sounds like a simple concept. You just want to watch your spending, right? In theory, yes. But, how do you actually make this happen? When it comes to finances, there is much more than just finding a deal at the store. Here are things you need to do in order to ensure you spend less and save more in 2016.

Set a goal. Why do you want to save more? Do you want to get out of debt? Do you want to increase your retirement savings? Perhaps you want to go on a trip at the end of the year. Whatever the reason, you need to write it down. Say that with me – Write. It. Down. Then, place that goal where you will see it every single day.

When you put your financial goals in writing, it makes them real. You can see where you are going as it is right in front of you. It might be on your bathroom mirror in the morning to remind you why you are going to work today. It might be a photo clipped in your wallet to remind you of the trip before you decide to go and get that latte.

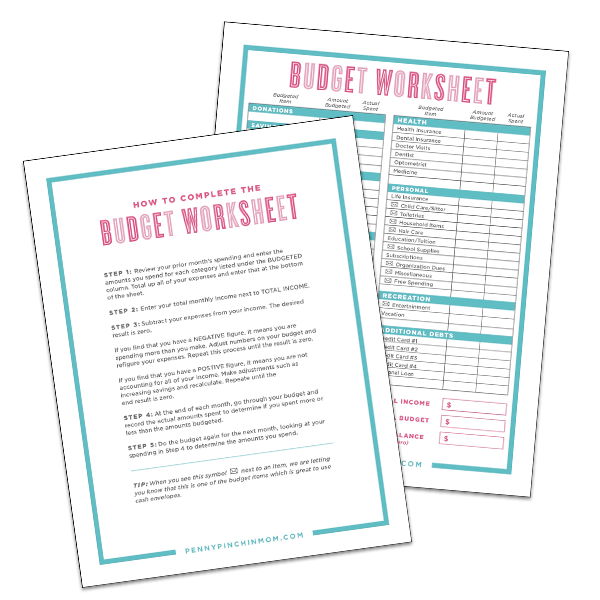

Create and follow a budget. If you plan a road trip to a new destination, you’d use a map, right? The same idea is true when it comes to a financial plan. You have to know how you are going to reach your financial goals.

The first thing you must do is create a budget. We’ve got an easy post you can follow – Budget Beginnings. This will help anyone who is new to setting up a budget know where to start.

Set small milestones. Now that you know how you are going to reach the goals you have set, you need to celebrate the small victories. Break your goal up into smaller sections so you can see that you are making progress.

For instance, if your goal is to save $5,000 for a trip, break that savings into time frames. Make your goal to save $1,000 in 3 months. Then, when you reach that goal, celebrate it. I don’t mean go out and blow money. Just revel in the fact that YOU DID IT! You are proving to yourself that you can do it. That will motivate you to move on and maybe increase your goal to $1,500 over the next three months.

Automate as much as possible. It is simple to decide that you don’t want to save as much out of this week’s paycheck because you want to go out to dinner at that new expensive restaurant. It might also be tempting to not put that $75 into savings so you can get that adorable new handbag you saw that the store. This is why you should automate as much as possible.

If you set up to make automatic payments or even transfers to your savings or investment accounts, you can’t spend the money on anything else. It just simply is not available (well, you could try, but you may risk overdrawing your account).

Take a look at your financial institutions and find a way that you can set up direct deposits, transfers or automatic bill payments. That way, you won’t be tempted to stray from your goal.

Check in often. Builders don’t grab plans to a home, look at them once and then never again. Walls would not line up, the rooms might end up too small and it, quite frankly, just would not work. The same is true with your finances.

Sit down at least once a month and check in. If you have a spouse or partner, it is even more important to do this. You need to always check to make sure you are on track. Expenses might change. Income may also fluctuate. Have regular meetings to go over your budget and check the path of your goals and make any changes as necessary.

These are the first things you should do to get yourself onto the path of financial independence.