Navigating through a world where dolls and financial strategies collide might seem unusual, but Greta Gerwig’s record-breaking Barbie film surprisingly delivers financial insights beneath its captivating storyline.

As any avid Barbie fan (like my daughter) or financial nerd (like me) can tell you, our plastic protagonist seems to live the ultimate financial independence dream. Lavish lifestyle, extensive wardrobe, dynamic social life, travel – she does it all. But how? Let’s unpack this and apply some Barbie-inspired wisdom to our own financial lives.

Lesson One: Invest in Your Education

Barbie’s had more than 200 careers in her lifetime, ranging from astronaut to surgeon to computer engineer. This resilience and adaptability are qualities we can all learn from. However, in reality, such career changes might require student loans, adding more financial burden.

The key takeaway? Investing in your education to broaden your opportunities is essential. It increases your earning potential and your ability to save. Furthermore, the more financially independent you become, the more flexibility you have to explore careers that align with your personality, desires, and life goals.

Lesson Two: Keep an Eye on Your Costs

Okay, not all of us have been blessed with the earning power of Barbie, so the next lesson that is perhaps more achievable is to keep an eye on your costs.

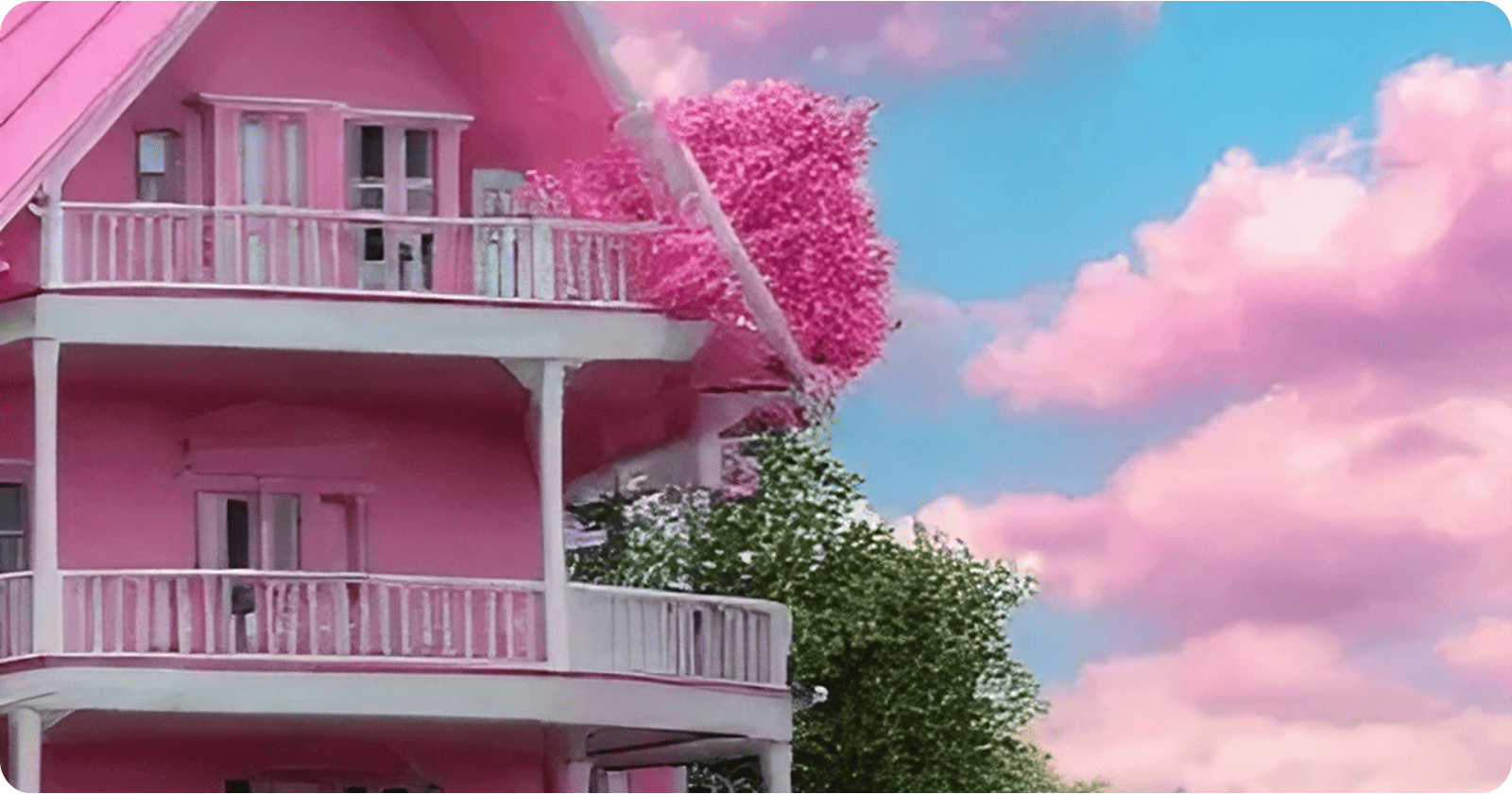

You see, Barbie lives in a glamorous house that would have a considerable price tag in the real world. After the Barbie movie’s DreamHouse became a real-life Malibu Airbnb, realtors at RubyHome analyzed the listing to estimate its real-life value. The 3,500-square-foot pink home with a private pool in a prime location, comes with a value of just under $10 million. If we apply typical mortgage rates, her monthly payment would exceed $110,000.

And let’s not forget about her outfits. With an ever-changing wardrobe, the costs quickly add up.

While most of us don’t have Barbie’s Malibu mansion or her expensive fashion taste, this lesson rings true: being mindful of your costs is critical. Are you splurging on items you don’t really enjoy or need? By identifying these areas, you can experience more satisfaction from your spending and move closer to your financial goals.

Lesson Three: Understand Your Goals

In the movie, Barbie embarks on a journey to find her purpose in life. This resonates with us all, doesn’t it? What are your true priorities? Travel, quality time with family, volunteer work, career progression?

Understanding your goals will give your financial planning a clear direction. Each investment, saving, or spending decision becomes purpose-driven, enhancing your sense of fulfillment. The value of financial independence or simple goal-setting lies in this awareness, enabling you to align your spending with your ultimate life objectives.

While we might not live in a Barbie world, we can certainly apply some of her lessons to our own financial journey. In a way, these lessons are about more than just money. They’re about identifying what truly matters in life and using your financial resources to reach those goals. So, as you make financial decisions for your family, keep these lessons from Barbie in mind. They might just lead you to a more fulfilling and financially secure life.

So, no matter where you are in your financial journey, remember – it’s not about living a Barbie lifestyle. It’s about understanding your financial reality, aligning your spending with your goals, and finding true fulfillment in life. After all, isn’t that the ultimate dream?

Stay financially savvy, my friends, and may your journey be as colorful and diverse as Barbie’s many careers!