We use our phones for nearly everything. There is social media, contacts, our schedule and more. There are apps for everything we need, including budgeting. One of those apps is EveryDollar.

I am thrilled to have had the chance to partner with Ramsey Solutions to bring this sponsored to you! All opinions are my own and were not influenced by any parties.

Anyone who has followed my site for any time knows that I am a stickler about budgets. I don’t care if you use good old paper and pencil or a spreadsheet. The point is that you absolutely must have a budget. There is no denying that.

The thing is that I also understand traditional budgets do not work for everyone. We are all different. That is also true when it comes to your budget. What works for one person doesn’t work for the next.

While many are good with the budget methods mentioned above, I know that is not always the case for everyone. Many people would much rather have an app to help them out.

If this is the way you would best budget, then you should do so. But, don’t use just any app. You should check out EveryDollar.

While I am a spreadsheet gal by nature, I tried out this app for a month and loved it! It was super easy to use and helped us make sure that we were on track (which we found were off on a few of our budget amounts). Below you’ll find my full unbiased review of this app, so you can decide if it is right for you or not.

WHAT IS THE EVERYDOLLAR APP?

EveryDollar is an app that was created by the Dave Ramsey team. If you know Dave, you know he has this budget and money thing figured out.

EveryDollar is accessible via desktop, iPhone, and Android. Every Dollar follows Dave’s proven plan to help millions of Americans not only get out of debt but also save.

The reason it works is that it allows you to track every penny you spend, every month. It also helps you see if your spending behavior aligns with the budget you’ve created. You can identify where you are overspending and additional ways you might be able to save.

The app also helps anyone who is getting started with the baby steps to help you build your emergency fund, get out of debt, and live the financial life you want.

HOW DOES EVERYDOLLAR WORK?

EveryDollar is one of the simplest apps I’ve used (and I’ve tried many of them). It takes just a couple of minutes to create your account. Then, you are ready to make your first budget.

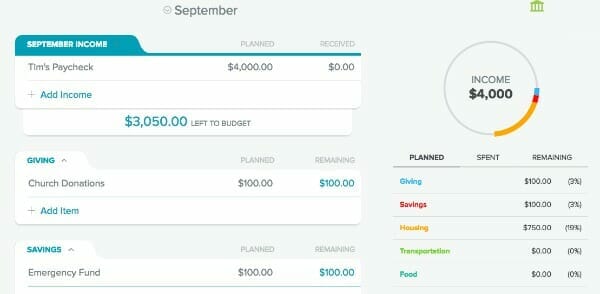

First, enter your take-home pay in the income section. Then, start filling out the rest of the budget form. I love that they provide you with the essential categories, so you do not forget to include items.

You can easily edit, move and even add additional items to the budget. If some of the categories they list don’t work for you, you can remove them. It is completely customizable.

Once your budget is ready, EveryDollar will show you how much of your money goes to each line item. You can then quickly make adjustments to your budget, so it aligns with your budget goals.

TRACKING YOUR SPENDING WITH EVERYDOLLAR

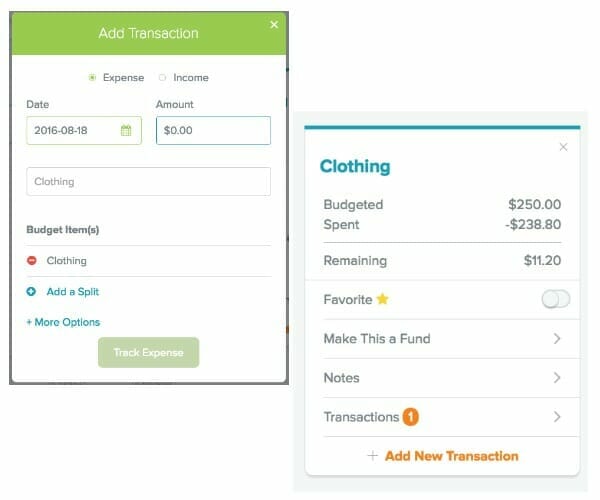

Tracking your spending is one of the best features of the app. You update it in real time, so you always know how your budget looks.

Once you spend money at the store, restaurant — wherever enter the amount you paid into the app. Your budget updates in real time, so you know how much you have available to spend for each category listed.

For example, let’s say you have $500 budgeted for groceries. You stop by the store and spend $47.23. You will enter that transaction into the app and find out that you now have only $452.77 left to spend on food for the month.

This app keeps your spending and financial picture right at your fingertips – no matter where you go.

IS EVERYDOLLAR ONLY FOR THOSE WHO USE CASH?

Absolutely not! That is part of the appeal, in my opinion. It works for both the cash and even the debt or credit budget. It updates in real time for you to see where you spend your money.

I recommend EveryDollar to anyone who does not use cash. The reason is that it helps you better track your spending. As you use your debit card at any location, you just take a minute and enter the transaction into your app. You always know how much you have left to spend in each category.

FINAL THOUGHTS

The EveryDollar app can be eye-opening as it shows you exactly where your money goes every month. You no longer need to worry about whether or not you are following your budget. It helps ensure that you do – no matter what.

If you are just trying to get started using the Dave Ramsey method or have completed some of the steps, this is your blueprint to help you achieve financial success.