If you’ve followed me for very long, you know that I am very organized. I am always keeping our home decluttered and organized so that we can find anything we need. This includes our important documents, such as receipts, manuals, and warranties.

I’ve always been afraid to throw those documents away. While I’ve not really ever needed any of them, there have been times when I was glad I did. And they actually saved us money!

Around a year ago, our kitchen faucet was leaking. We knew it was less than a year old and it shouldn’t already need to be replaced. We found the part to repair it and were ready to spend $50 for it to get shipped to us when I noticed a link regarding warranties. I clicked on it and read on.

Sure enough, our item WAS under warranty!! We had to have our receipt, though. Being that I had saved all of those documents, I was able to quickly find it, and we were able to get the replacement part at absolutely no cost!

This same situation came up when our freezer stopped working. It too, was still in the warranty period, and since we had the receipt and other documents needed to prove that, we were able to get a brand new freezer — for free!!!

It was in these moments that I was glad I had become so diligent with saving items. Doing so can also potentially save you money. If you are not sure how or what to save, here are some ideas:

How To Organized Important Documents

- File Box. This is the method we use (you can find the style of box HERE). I have several of these boxes and within them, hanging file folders. These are labeled so I can find what I need. The categories depend upon what you need. Here are those we use:

- File Drawer. If you do not have very many of these, you could easily find a file cabinet or drawer in which to store them. It is still best to keep them organized by category so you can find what you need when you need it.

- Notebook. I actually tried this method, and it didn’t work for me (you can read about that here). This does work for many and might be the best option for you. If you do decide to go with this method, I would recommend that you purchase higher quality STURDY plastic sleeves for your items (I think that is where I went wrong). You should still divhttp://www.amazon.com/dp/B001CQFRPO?tag=pennypinchinmom.com-20de the items by category so that you can find the items when you need them.

- Paperless. As an extra form of protection, you can scan in items via a Neat Scanner or regular scanner. Then, create a file folder on your computer, and/or online cloud storage, for these items and organize them accordingly. For example, create a folder called “Home Items.” Under that heading, make additional folders called Electronics, Appliances, etc. I know putting some of these most important documents in the cloud is a little scary, but so is losing all of this hard to replace info if your desktop or hard copies are stolen. Another option would be to purchase an external hard drive (and make it password-protected) and put it in a safe deposit box. Then every few months, update the drive.

How Long Should You Keep Important Documents?

Now that you know HOW to store them, what should you keep and how long?

- Tax Forms. Keep these for seven years (along with any documentation). In order to ensure you don’t end up with too many, it is a good idea to take out the oldest return each year you file away the most recent one. For example, when you put away your 2013 return, you can take out the one for 2007 (and any prior to that time). Make sure you do NOT just throw these in the trash, as there is personal information that thieves will use for identity theft. Make sure you shred all items! You can find a shredder for around $30 on Amazon.(Note: If you have a unique situation such as a business or complex return, you may need to retain these for a longer period of time. You may want to consult with your CPA).

- Owners Manuals. There is not really any need to keep these anymore since most of them are available online. I will admit that I still do, as I still am old school when I need one and like to pull it out and read it. But again, you can toss these.

- Warranties. You should always keep these along WITH your receipt (stapled together). By doing this, you will easily find the details about your warranty as well as have the documentation you need should it ever be needed.

- Receipts. Most store receipts are valid for returns for up to 90 days. For big-ticket items, it is good to always keep these and attach them (as mentioned in #3 above) or keep them in a folder.

- Bank Statements/Mortgage Statements. There is no need to ever keep your bank statements or mortgage statements as long as you have access to them online. If your bank does not have this feature, it is only necessary to keep them for one month. As you reconcile your account, toss out (actually shred) the prior month’s statement.

- Bills / Credit Card Statements. If you use these to keep track of payments, you should keep them only until the next month’s bill arrives and you confirm the correct payment amount was applied to your account. Bills and credit card statements should always be shredded or destroyed. We actually do not keep any of these and shred all of them. However, we do scan any of these that would be needed for tax purposes, so we have them as documentation.

- Tax Documents. As you go through the year, there are things you know you will need for your taxes. Rather than put them where you have to go digging at the end of the year, you could instead put them all into one folder. This is what we do. Receipts, purchases, etc., all get put into one folder. Then, come tax time, we have everything we need in one folder — no digging or researching necessary!

- Medical Receipts/Medical Records/Health Insurance Policies. These items should be saved through the end of each calendar year in case you need to check payments to show deductibles, additional claims, etc. If you include anything from the paperwork on your taxes, save those items with that year’s taxes. If any items are associated with Worker’s Comp, you should contact your attorney or CPA about the length of time to keep those records.

- Legal Identification Documents. Important documents that you rarely use, like your birth certificate, marriage certificate, Social Security card, passport, powers of attorney, death certificate, transcripts, diplomas, etc. are super important documents that you need to keep forever.

- Pay Stubs. Keep one year’s worth of stubs. If you need to show proof of income, most companies will not require anything further back than this period of time.

In order to ensure you purge items you no longer need (warranties that have lapsed, etc), make sure you go through your files at least once per year and put the expired ones in the recycle bin to reduce paper clutter. The easiest time to do this is when you are filing away your most recent taxes. You are already looking at your files to do this, so just take a little more time and clear out those old items you no longer need.

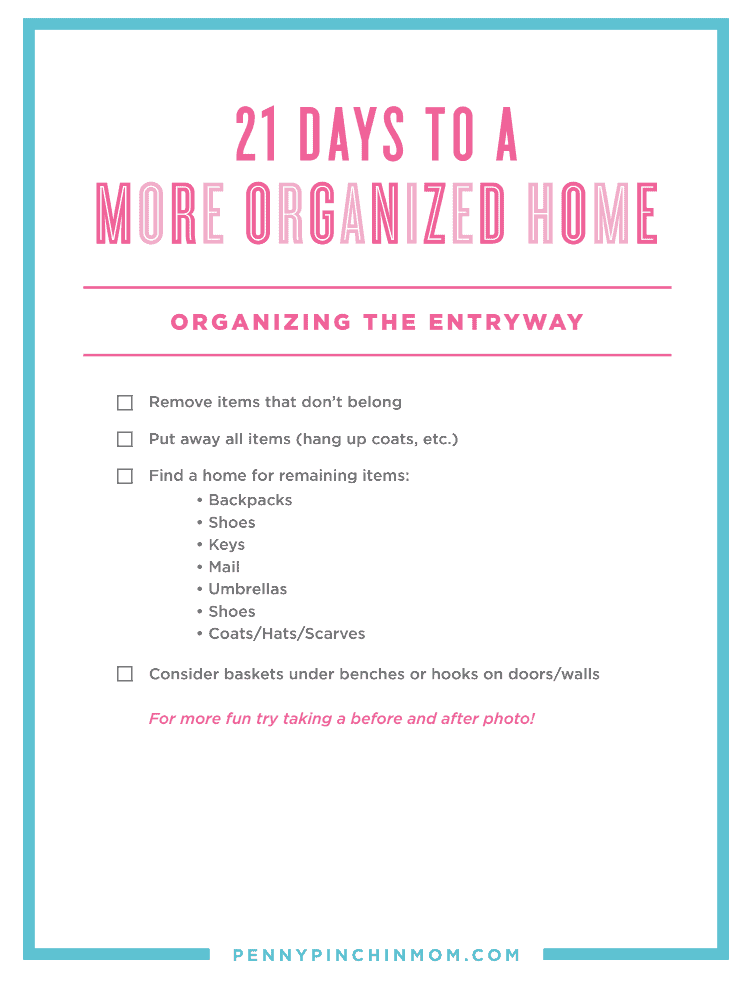

Free 21 Days to a More Organized Home Printable

To help you get organized and figure out what to do with all those piles of paper you have, I created this free, 14 page 21 days to a more organized home printable, with checklists to organize the kid’s toys, pantry, bathroom, and more!