My husband and I began thinking about college for our kids when they were just infants. We set up savings accounts for them and have been contributing regularly for years.

As great as that is and even though we have been planning for what will happen (sooner than I think either of us will ever be ready for), there may be a chance that one or all three of our children will still need to supplement college expenses by taking out a loan.

I know that this is the situation many parents also find themselves dealing with as well. Sometimes, despite the best intentions and planning, there ends up being a shortfall in covering college. It is also not only the cost of tuition, but there are books, supplies, food, and living expenses. This can be a very large burden on many families.

For these reasons, many will need to take out a student loan. The question then moves from “how to do I pay for this” to “where do I go to find a trusted lender?” Let’s face it, there are a lot of companies out there which do not have your best interest at heart and would love to do no nothing more than to take your hard earned money. I don’t want that for you – and of course – neither do you.

While my kids are not yet ready for college, I have a couple of friends who have been through this and they’ve shared their frustrations with the process and how it needs to be easier. I agree with them. Fortunately, I learned about College Ave Student Loans and was able to pass this along to my neighbor (who’s daughter is graduating from high school this year).

One feature I was able to share with her was the new Parent Loan. This offers savings over Federal Plus Loans. These have no origination fee and a lower fixed interest rate than the federal program. The College Ave Student Loans new parent loan offers qualified parent borrowers an average savings of $1,000 vs. the Federal Direct Parent Plus program. That is money right back in your pocket! Check out their qualification tool so you can apply right now!

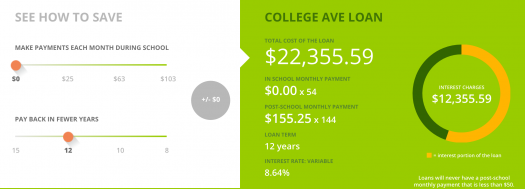

Another great thing about College Ave Student Loans is that they offer much more flexibility to fit your own financial situation when compared to other private parent loan options. For instance, there is an option to get up to $2,500 deposited directly into parents’ bank accounts so they control the spending for extra education expenses like books, electronics, dorm supplies and more. Not only that, but parents also have the option to start paying in full right away, or to limit monthly payments while the student is in school, and to pick their own repayment terms from 5 to 12 years.

College Ave Student Loans, a leading online student loan marketplace lender, and Experian®, a leading global information services company, are offering a limited time joint offer of a credit health check — a complimentary, personalized credit education session with an Experian Credit EducatorSM agent — to families preparing to pay for college. College Ave is collaborating with Experian to better support parents who may need to consider borrowing or cosigning a private student loan if savings, scholarships and federal aid fall short of higher education costs. Families who may want to explore private financing options should start getting ready now. The personalized credit education session offers an in-depth, one-on-one, 35-minute phone call with an Experian Credit Educator agent. During the session, parents will receive a copy of their Experian credit report and score and a personalized, step-by-step walk-through of the report, as well as examples of actions that may improve their credit score and insights for future credit management decisions. For more information about how to access the free credit education session, visit https://www.collegeavestudentloans.com/crediteducator.

College Ave Student Loans has really found the perfect balance where they make the student loan process easy and simple, as well as affordable. After all, they want the same thing as parents do — a bright future for their children.

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.