Does not having debt affect your credit score? Not necessarily.

When you are working yourself out from debt, you do not use credit cards. Or, at least, you should not use them. Using cash is important while you are on the path to financial freedom. After all, credit cards are the reason many people are in debt in the first place.

Many people who are debt free choose not to use credit cards at all. This is very common. People who used credit incorrectly in the past worry that they will fall into the same spending traps again. I get that.

However, those who do not use credit cards worry about their FICO score (i.e. credit score). After all, if they have no debt at all, will this number not go down?

It is true, your FICO score is based upon your debt and how will you repay it back to the debtor. Your FICO score takes several components into consideration:

10% based upon your type of debt

10% based upon new debt

15% based upon the length of time you have been in debt

30% based upon your debt level

30% based upon your debt history

What is important to realize is that your FICO score does not take into consideration your debt to income ratio. It also does not consider what you have in savings. So, if your debt to income ratio is only 15% and you have $25,000 in the bank, is your score really indicative of how you manage money? Of course not.

Something that many people may not realize is that paying loans off early has absolutely no effect on your credit score. It does not improve (nor hurt) it in any way. In fact, there is no “bonus” to your score for paying off items early. It simply only looks at if the loan was paid on time. That’s it. So paying off your loan early doesn’t hurt nor help your score in any way. However, those debts where you are missing payments will absolutely hurt your score.

YOU MUST BORROW MONEY

If you want to maintain a good FICO score, you have to borrow money. There is no other way to do it. That means you must have debt. Even if you pay off a card every month, for a short time, you carry debt. Here is now debt is defined:

You’ll notice that it doesn’t say “unless you plan on paying it off at the end of the month, then it is really not debt.” Anytime you use money that is not yours, it is debt.

[clickToTweet tweet=”Anytime you use money that is not yours, it is debt.” quote=”Anytime you use money that is not yours, it is debt.”]

Whether or not you pay your balances in full every month, it is still debt. However, that doesn’t mean it is a bad thing. It can actually help you with your score.

THE SIMPLE WAY TO INCREASE YOUR SCORE

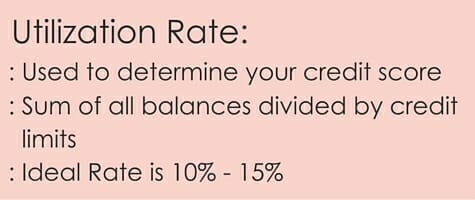

If you really want to increase your credit score, the simplest way to do that is with a credit card. Just make sure you use it the right way. The reason this is the recommended method of creating credit is so that your utilization rate can be calculated. So, what is a credit utilization rate?

Here is a way to look at this in a practical sense, if you have a credit limit of $2,000 on your card and you have charged a total of $500, then your utilization rate would be 25%. That could end up lowering your credit score. The reason is that creditors believe that the higher your balance in relation to your credit limit, the less likely you will be to replay it (you as in “general public).

Of course, the best way to use a credit card is to always pay it in full every month and never charge too much on it. These are tips which can help to keep your score on the rise.

MYTH DEBUNKED

It really is fact that you must have debt to have a good credit score. That doesn’t mean long term debt. That doesn’t mean you do not pay it off every month. Debt is debt – no matter if you pay it back 3 days or 3 years from the time you made the purchase with a loan or credit card.

Whatever you do, do not let your FICO score control how you handle money. It is one small part of your financial health. What matters most is the manner in which you live your life – debt free to live like you want rather than being tied to a three digit number.

(I am not a financial advisor and the information listed within these posts is not to be construed a financial advice. Financial concerns/issues should be addressed with a professional in order to receive advice and assistance.)