This is a sponsored post on behalf of Allianz Global Assistance (AGA Service Company). All opinions are my own and were not influenced by any parties.

College. It’s a parent and student’s dream to move away from home and continue his or her education. College. But what happens if a student unexpectedly needs to take time off from school? What if they get ill and don’t graduate?

These are things we think will never happen to our own families, yet these scenarios play out all the time. As parents, none of us want for our child to quit school prior to graduation. But, the truth is, that this is reality for many.

According to the National Center for Education Statistics (NCES), only 59% of students who started college in 2009, graduated four years later (in 2015). That is a dropout rate of 41%!! The problem is not that they quit. No, the problem is the money paid towards tuition costs. That is money that is literally thrown away. Or, it used to be.

Believe it or not, you can purchase college tuition insurance for your student. Imagine resting well, knowing that if your student must leave school before the end of the semester, you can get those tuition costs back.

This is not a product offered by most insurance companies. However, you can find tuition protection through Allianz Global Assistance.

IS THIS REALLY NEEDED?

In the same report released by the NCES, a four-year degree is not as common as it once was. Now, it is taking upwards of six years for students to get their degree. This in turn, increases a family’s financial risk.

In addition, it is becoming more and more common for students to take time off during the middle of their college career. They need a break from their education. However, most colleges and universities will offer only a partial refund after a certain point in the semester. (It is important that you understand these policies at your student’s college or university).

What happen if your child becomes too ill to finish his degree. Or, what if your student is so overwhelmed by college that she just can’t do it. Not right now. Imagine paying for a full-semester’s tuition, just for your student to quit and that money being gone. You have zero to show for it.

As parents, we insure and protect investments such as our homes and cars without thinking twice. Why shouldn’t we also protect our tuition investments too?

WHO NEEDS THIS TYPE OF INSURANCE?

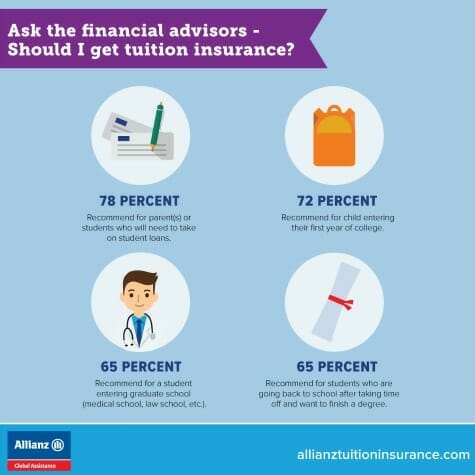

In 2016, Allianz conducted a survey. They reached out to financial planners and asked them several questions. Most of these men and women — 8 out of 10 — recommended that parents consider some type of tuition insurance, to protect this investment.

Here are some of the most interesting stats from the survey:

-

- 78% recommend for students taking out loans

- 72% recommend for families with a first-year college student

- 65% recommend for students entering graduate school or those who are going back to school after taking time off.

Financial advisors are here to protect our money. Learning that so many recommend we protect college tuition costs makes it something that we, as parents, should absolutely consider.

HOW DOES IT WORK?

Allianz tuition insurance gives students and parents peace of mind. It offers reimbursement for tuition, fees, housing and meal plans if your student unexpectedly withdraws from school prior to the end of the semester. The plan even helps with any emergency travel or medical situations that may occur through a 24/7 student assistance program.

One word of caution: It is important that parents understand that the plan must be purchased prior to the first day of each semester which allows flexibility for students.

WHERE DO I GO FOR MORE INFORMATION?

Allianz offers different plans and options, so you can select the one that works with your budget and needs.

Paying for college is an investment in your child’s future. It is important that you protect your investment. Should your student withdraw, you will be able to support them when they are able to return to school