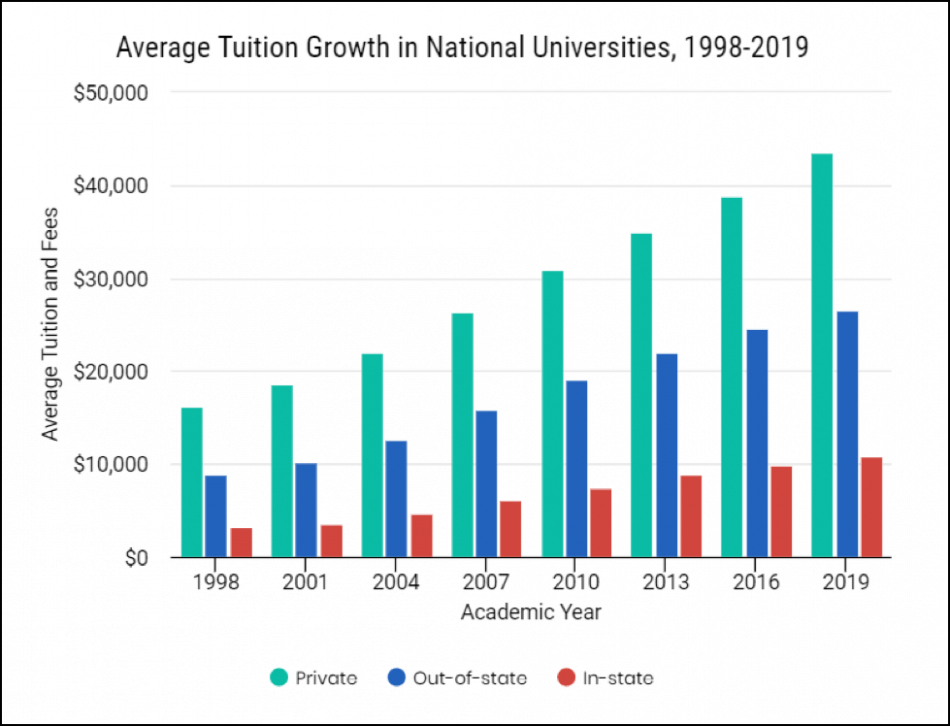

The cost of college has been on a steady climb for the last two decades. Source: USNews & World Report

Whether it’s a private, out-of-state, or in-state university, it’s simply a matter-of-fact that college education gets more expensive each year.

And we’re not even counting housing, books, transportation, food, and other college-related expenses.

Based on a survey conducted by US News & World Report, more than 66% of 2017 college graduates had to take loans to cover the costs of getting a college degree. Student loans have more than doubled since 2009, according to the Federal Reserve.

And it gets worse. According to a survey conducted by T. Rowe Price in 2017 entitled, “Parents, Kids, and Money”, 62% of the participating kids said they are expecting their parents to be able to afford any college they would like to attend.

While this puts even more pressure on parents, the results of the survey revealed that 65% of parents say they can only cover “some” of the expenses for college – which could basically mean anything.

If you’re a parent, you’re probably looking at all these bleak figures and wondering, “How am I going to prepare to pay for my child’s college education?”

As with all financial decisions, it starts with getting the right information. And, if you’re reading this, you’re off to a good start. In this article, we’ll take a look at several ways to plan your finances for your child’s (or children’s) college the right way.

Plan and build a college fund early

It all starts with having the conversation with your spouse (and kids, eventually) so everyone is on the same page. Setting expectations with regards to your child’s options in choosing a college keeps their perspective within the family’s financial capabilities.

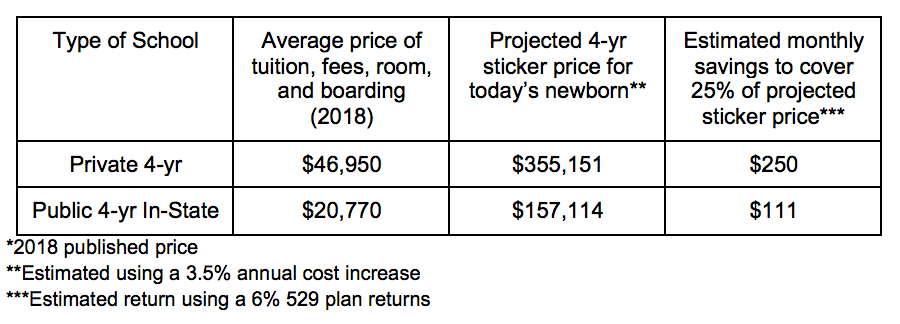

The following table was based on an article from SavingforCollege.com, which gives a rough estimate of how much college could cost along with a savings estimate:

So, the child shouldn’t be the one driving which college to choose from, but rather you and your child’s budget along with post-graduation student loan debt. A good rule of thumb to remember when it comes to how much student loan debt a child can incur is to keep at less than their first year starting salary.

Leverage a 529 Plan

In a nutshell, a 529 plan is a college savings vehicle that allows you to save money on a tax-favored basis.

When you contribute to a 529 College Savings plan, the earnings grow tax free as long as you use them for qualifying college expenses. Over 30 states offer full or partial state tax credit or deduction for 529 contributions.

Aside from the tax advantages, 529 plans are flexible, easy to set up and maintain, and contributions do not have to be reported on your federal tax returns.

Parents should strongly consider getting a 529 college savings plan due to its tax advantages and benefits. It’s a great way to build up funds for your child’s future education as well as save money on state taxes.

Utilize financial aid and other similar programs

These include scholarships, grants, work-study programs, and federal or private loans. And the first step in applying for financial aid is to complete the Free Application for Federal Student Aid or FAFSA.

There are two types of financial aid: Merit-based and needs-based.

- Merit-based aid is awarded by colleges, institutions, and private organizations for displaying a specific talent and/or academic or athletic ability.

- Needs-based aid is awarded and determined by a family’s financial ability to pay for college based on FAFSA’s assessment.

Pay debts and keep overall household costs down

To be in a position to save a couple hundred dollars per month requires that you’re caught up with other expenses. This might mean making some slight adjustments in luxury expenses at home or making sure you’re not in debt by the time your child begins college.

If you weren’t able to save money prior to your child going to college, then it’s going to come down to paying for it with your current cash flow. That’s why it’s vital to have debts paid off by the time they start college so you’re able to allocate enough cash flow to pay for college expenses as they are incurred.

Proper college planning is achievable

Let’s face it. Coming up with a strategy to fund your child’s college education requires both emotional and financial preparedness. The key is to start early so that you and your child won’t be in insurmountable debt later.

Talk to your spouse and child, set expectations, utilize financial aid programs, and start building a college fund. Doing these will save you from a lot of headaches and debt later, plus it ensures a much more comfortable college experience for both you and your child.

Clint Haynes is a Certified Financial Planner® and Financial Advisor in Kansas City, Missouri. He is also the founder and owner of NextGen Wealth. You can learn more about Clint at his website NextGen Wealth.