This is a sponsored post on behalf of BusyKid. All opinions are my own.

I’ve got three kids. It seems that there one of them is always wanting money for one thing or another. But, the thing is, the “Bank of Mom and Dad” does not like to just give them cash for just anything. They have to earn it.

There is a lot of controversy over whether or not parents should pay their kids for doing chores. For many parents, tasks such as cleaning your room, setting the table, mowing the lawn, or taking out the trash are just part of what you need to do as a member of the family.

It makes sense. However, in what ways to kids earn money? Is it a weekly allowance, or are there other ways that your kids earn money?

In our family, our kids do not get paid for doing the things that we tell them to. They each have weekly chores for which they are responsible. Those will earn you nothing more than a “the kitchen looks nice” after you do the dishes.

Our kids can earn money but only when they do the things that are above and beyond what is asked of them. Decide to pick up the family room without being told? Earn money! See that the kitchen is messy and clean it up? Earn more money!

But tracking these on old school chore charts no longer works for them. They are just too old. And, even some of the other creative chore chart options just don’t work. Our kids are growing up, and that also means so does the way we track and pay them for doing things around the house.

My husband and I found BusyKid and decided to give it a try.

My BusyKid App Review

What is BusyKid?

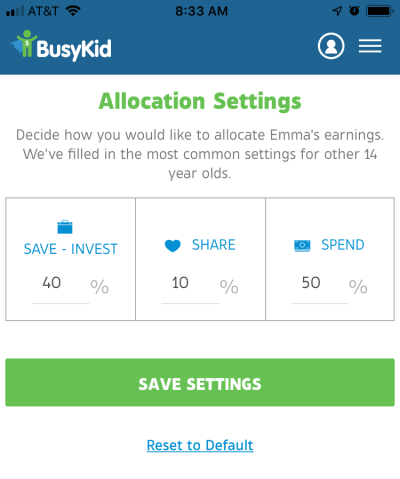

BusyKid is a chore system app. But, it is more than that. The app allows parents to allocate the money the kids earn into three different buckets — give, earn and spend.

It is an app that helps you kick start money conversations with your child. Financial literacy starts at a very young age, so as a parent if there is a way to do that which is easy for me to maintain, I’m all over it!

I made a lot of money mistakes and did not want my children to ever go through that. Ever. My husband and I are big on teaching our kids how to be responsible with their money. The app meshes perfectly with our money views. The idea that we need to make sure children have a healthy relationship with money sets them up to be financially-wise adults.

What better gift can you give to your child?

How does BusyKid work?

It is super easy to use. You create your account and connect it to your bank (all encrypted, so it is safe). Then, you add your child’s information as needed. Assign them tasks. When they complete them, they get the money allocated to their account.

But, the kicker is that they don’t get the full payment given to them. Nope. They will be given only a certain percentage to spend. The other money they earn is split between save and give.

The app teaches your kids not only how to make money but how the importance of saving. It starts the skills of saving a little from each paycheck, so they can first pay themselves.

Kids also learn about giving. Giving to others is very important. BusyKid knows this as well!

Let’s walk through this in detail.

Getting Started with BusyKid

If you are ready to jump in use an app that will not only help with chores and responsibility but also teach financial literacy, then pop over and download the BusyKid app.

Once you do that, you will sign up. One of the first things you will be asked to do is to connect your bank account. That is how you will pay your kids. It moves from your account so it can pay them (I’ll share how that happens a bit later).

After you connect your account, you will add a profile for your child. You can add a picture (if you wish) but will also need to add their name, and birthdate. You will also assign a PIN to their account. If they have a cell phone, you can attach their number to the account as well.

Assigning chores

Once your child’s account is created, it is time to get busy assigning them chores! From the parent dashboard, you can select your child from the profile. Then you will select the Add Chores button.

Here you can assign the chore and attach a value to it. You will even determine the frequency that they need to do the task. For example, taking out the trash may be required only on Monday night whereas set the table is every night of the week. Then you decide how much that is worth.

You can assign and remove tasks as frequently as you would like. As the parent, you are in complete control!

How your kids track their progress

Then, each family member adds the app to his or her device. The login credentials are the same for everyone (as you will share one account). But, the difference is that you can only log into the account that you have the PIN for. That means your kids can only log into their account to track their actions. (Mom and Dad have the pins to access this for anyone).

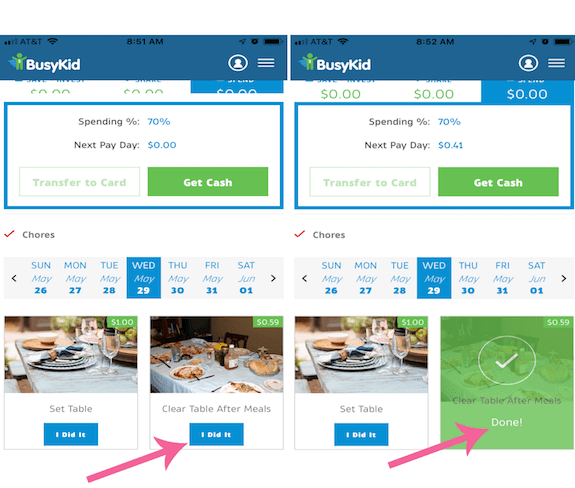

Once your child has logged into his or her account, they will see a screen that looks like this:

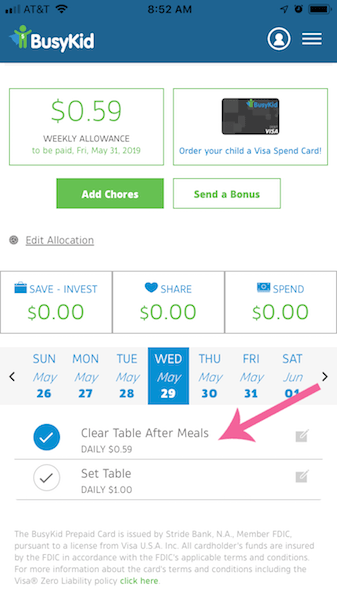

As they do the task, they click the blue I Did It Button. The completed task is recorded on Mom and Dad’s account. You will see that they completed the task on your dashboard:

It is simple to see that your kids are doing what they are supposed to and being responsible enough to track it. If they don’t mark it done, you can’t pay them! It forces them to take ownership as well in making sure they get their money each week.

How do you pay your kids?

I love this the best! You can pay your kids through a pre-paid Visa card on payday, which is Friday of each week. Rather than traditional cash, kids get a card that is loaded with the money they have to spend!!

As a parent, you have full control over the percentage breakdowns as you pay your child. If you want to help them save for a car or college, you can increase the savings percentage to 40%. As the parent, you have complete control over the way your child saves and spends.

Rather than pay them and tell them to put a certain amount towards savings and charity, they get only the amount they can spend loaded onto the card. For instance, if they get paid $10 and you decide 10% should be given to charity and 20% saved, they will only receive $7 on their card.

The reason I love this feature is that it teaches kids about money in the cloud and how to spend with plastic. Even though our family is big on a cash budget, we still understand the importance of our children understanding how to use a debit card.

You get the confidence that your child can learn many financial literacy lessons with a straightforward action.

Teaching your kids about giving

Money is about more than spending. It is also about giving. I mentioned this above, but it is so important that it deserves another mention.

BusyKid believes in helping others. And, they believe that kids need to learn this lesson early in life. If they learn that this is part of making money, then it will be normal for them as they grow. They too will use their money to help others in need.

What a great lesson!

BusyKid has a list of charities that your family can decide to donate too. These include the Juvenile Diabetes Foundation, Toys for Tots, Special Olympics, and more. There are more than 20 charities that you can choose from. And then, on payday each week, the money will be given the charity of your child’s choice.

Helping kids learn to save

One unique feature about BusyKid is the value the put on saving and investing. They encourage parents to

Common Questions

While I explained how the app works (and why it is so awesome), you may still have a few other questions.

Do I have to link my bank account?

Nope! You can start out without linking your account. But, you will need to do so eventually, or you can’t pay your kids.

Can I use a credit card?

Absolutely. But, you are charged 2.9% of the transaction fee + $0.30. If you don’t want to pay money to pay your kids, you will want to use the bank account (as it is free).

What are you doing with the funds you take from my account?

Excellent question! All money is held in a BusyKid account and an FDIC insured bank for your benefit. BusyKid makes no money on the funds that are held. They are insured on a “pass-through” basis only. That means your balance is protected by FDIC, up to the limits established.

What does it cost?

The fee is $24.99 for the year – for your entire family. That breaks down to a little more than $2 a month.

Is there a trial period?

Yep! You can try it for free for 30 days. At the end of the trial period, you will need to cancel, or you will be charged the annual fee. Don’t worry – they are really good about sending you emails letting you know that you are nearing the end of your trial period. (They don’t want you to pay for something if you find it is not a fit).

My honest thoughts

I am not big on apps (ask my husband). But, there are some that I regularly use – because they work. With three kids who always need to get paid for work around the house, it is a simple solution. There is no more of them asking me for money – they know what they need to do so they can get paid.

Add in the bonus that the app teaches them financial literacy, and it makes me love it any more. My husband and I are doing all we can to make sure our kids have the right financial education. If that means using a tool to help us, we are all about that.

BusyKid is the app that just really does it all. It is affordable. It is educational. It just works.