My husband and I have had our written budget in place since November 2008. Before that, we were more of a “well, I have a list of the bills I need to pay” type of couple.

Our budget helped lay the framework to help us dig out from more than $35,000 in debt in a little more than 2 years. It truly was the jump start we needed in order to reach our goal to be debt free (outside of our mortgage).

As we look back at the way we looked at money both pre and post budget, it is amazing the difference. The way we look at money and how we handle it has changed greatly!

I recently found Dave Ramsey’s post about 19 Things Only budgeters understand. As I read the list I chuckled and nodded as I read through them. I decided to create my own list of things only those with a budget will truly understand. Let me know which ones you can relate to.

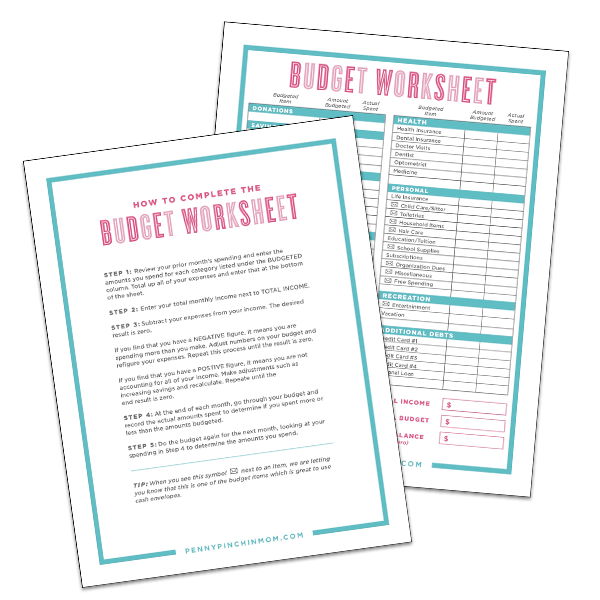

Read More:

- How to Create a Budget That Actually Works

- Learning To Budget With Irregular Income

- The Tricks to Making a Budget If You Are Broke

- The Categories You Must Have In Your Budget

Things Only People With a Budget Truly Understand

1. You don’t hit the grocery store without a list in hand. And your list was created from your menu plan. No more random tossing of groceries and hoping that when you get home there is a meal in there somewhere.

2. No more buyer’s remorse. You saved for it. It is in the budget. No worries that you can’t pay the mortgage because you went shopping.

3. This year’s vacation has already been paid for and you are planning out next years.

4. January is your favorite month of the year – because you don’t have to worry about bills coming in the mail and can instead update the budget because of an income adjustment.

5. You get giddy when you see your budget hits zero.

6. Sales emails go into your trash can. Who gets tempted to shop every time you see a “free shipping” or 50% off deal?

7. Your friends ask you for help with their own finances.

8. You enjoy infomercials for the entertainment value only. I mean, if they really did what they promise, it might be fun to buy them….oh, who am I kidding. We’d never buy that stuff!

9. You know how to walk away and think twice before you buy.

10. Within two weeks your toddler floods the upstairs toilet (which ruins the kitchen ceiling), the garage door needs to be replaced and the air conditioner goes out. You just roll with it because it is life and you have emergency savings for this reason. (Yes, this is a true story).

11. Date night doesn’t mean a fancy dinner out, but pizza and your budget.

12. You know, within a dollar, how much money you have in all of your accounts.

13. You hate your car, but you hate car payments more.

14. Overdraft fees? You mean they still charge those?

15. You say “not in the budget” and your kids know what it means.

So, which of these do you relate to?