Each payday you have great intentions. You swear that this is the month where you aren’t going to spend too much money. You are going to watch every penny and keep your spending under control. Before you know it, you can’t even afford to buy groceries. Is there an answer to your problem? Yes. STOP SPENDING MONEY.

Overspending is a problem which affects many people. Whether you are rich or struggle to make ends meet, you too might find that you spend too much. Some reasons are financial, and others are emotional.

The first way you can get spending under control is to take a look as to why you are spending too much. That is the first step. No one can answer this question but you.

After years of helping thousands of readers (just like you), I’ve compiled a list of the top 12 reasons that people overspend. You might find yourself in one, two or even more!

HOW DO YOU KNOW IF YOU ARE OVERSPENDING?

YOU’VE MAXED OUT YOUR CREDIT CARDS

When there is no room to charge anything on your cards, you might have a problem. In most cases, maxed credit cards signals you are living beyond your means. If you have to continue to charge because you don’t have money, then you are spending too much.

YOU CAN’T FIND A HOME FOR YOUR LATEST PURCHASE

Your temptation might be electronics or handbags. No matter what you love to buy, you might notice you are running out of room to store things. When the stuff takes over your home and is causing clutter, it is time to take a long hard look at how you spend money.

YOUR BUDGET NEVER WORKS

There may be months when you don’t have enough money in your budget to cover your mortgage or food. When you continually spend money on the wrong things, your budget will not work.

That means if you have just $50 for entertainment, do not spend $75. That other $25 has to come from another budget line.

YOU SPEND MORE THAN YOU EARN

Take a look at your credit card balances. You might be paying only the minimum balance because you can’t pay it in full. When you spend more than you make and continue to add more debt, take a look at what you are buying. It might be time to pull back and stay out of the stores.

HOW TO STOP SPENDING SO MUCH MONEY

Now that you can see how you spend your money, the next step is to make a change. You have to stop throwing it away. Right now. Here are the steps to take to control and stop spending money.

1. MAKE A BUDGET

I know, I know. I probably sound like a broken record as I keep bringing up this budget thing. However, it’s true. If you do not have a budget, you have no idea where you are spending your money.

A budget is needed so that you can direct your money where to go each time you get paid. It also helps you know how much you have to available to spend on groceries, clothing, dining out and even entertainment. When you know you have a limited amount to spend on specific categories, you are instantly in control of our spending.

Read more: How to Create a Budget (even if you suck at budgeting)

2. PLAN AHEAD

Meal planning is one thing many people don’t think about when it comes to overspending. If you don’t plan your meals (and stock your fridge and pantry accordingly), you are more likely to run out to eat for dinner. Doing this at $25 a pop 2 or 3 times a week takes its toll on your budget.

Creating a meal plan will not only help you control your spending, but you might also find that you eat (and feel) much better too.

3. USE A SHOPPING LIST

Before you go to the store, it is essential you make a list. Check your fridge, freezer, and pantry so that you are not purchasing items you do not need – especially produce.

There is so much waste of food that expires before you can consume it. That results in you buying items so that they can end up right in the trash can. Make sure you plan your shopping trip and then purchase just what you need, as well as what you can eat before you hit the store the following week.

4. STOP PAYING FOR CONVENIENCE

There is a quick fix for nearly everything. You can find dinners in boxes, small pre-packaged snacks, etc. Rather than purchase convenience items, buy the larger size snacks and then re-package yourself into smaller baggies. You will not only get more out of a box, but you can even control how much you put into each baggie.

There are other ways we pay for convenience. We pay for someone to iron our shirts, wash our cars and even mow our lawns. By doing these things ourselves, we can keep much more money and easily stop overspending.

Read more: How You are Killing Your Grocery Budget

5. STOP USING CREDIT CARDS

We live in an age where our money is all digitally tracked, be it on credit or debit cards. Yes, they are more convenient, but they make it easy to overspend. When you use cash, it is impossible to overspend. You honestly can. Not. Do. It.

I hear all the time that people pay off cards at the end of the month and that they don’t overspend, but that is not the truth for most people. You might think that it is just $10 a week. However, that $10 a week is a hit of $520 over the course of a year. What could you do with an additional $500 in your pocket?

Read more: How to Create a Workable Cash Budget System

6. PAY YOUR BILLS ON TIME

We all have bills. We know when they are due. When you miss the payment due date, you get assessed a late charge. Pay them on time, so you don’t pay more than you need to.

In addition to late fees, not paying your bills on time can have an adverse effect on your credit score.

Learn how to organize your bills, so you never pay them late again.

7. DO NOT LIVE ABOVE YOUR MEANS

Few of us would not love new clothes or a new car. We all would like to make more money or get the hottest new device. The thing is, can you afford it? Is it a want or is it a need?

If you are using credit or loans to get items that you can not afford, then you are living beyond your means and spending money you don’t have. Scale back and make sure that you can honestly afford the house or the car and that it doesn’t ruin your budget and cost you too much.

Read more: Defining Your Wants vs. Your Needs

8. DON’T FALL FOR IMPULSE BUYS

Stores are sneaky about making us spend money. They use signs, layout, and even scents to lure you into wanting to buy more. The thing is, if you purchase something you did not intend to, then you are already blowing your budget and probably overspending.

Another way that you are spending too much is when you plan dinner but then decide at the last minute to go out to dinner instead. Why do that when you have food waiting for you at home (which you’ve already paid for)?

The final reason you may impulse buy is that of emotion. If you feel a rush because of that new item, you may purchase out of impulse and emotion instead of need.

Read more: Stopping Impulse Shopping

9. FIND ANOTHER BOREDOM FILLER

I remember being in an online forum when my kids were little, and we talked about our day. Many of the mothers went to the store every. Single. Day. They said they could not handle being in the house and just had to go somewhere. That resulted in them buying things they did not need.

If you are bored, find a new hobby. If you just need to get out of the house, why not go for a walk or play a game with the kids? Find a way to redirect your boredom so you stay out of the store and stop overspending.

10. USE FINANCIAL GOALS

When you do not have financial goals, you have nothing to work towards. You might want to get out of debt, or you may want that newer vehicle.

Take a look at what you are spending each week on non-essential items. What would happen if you would put that money into savings or paid off your debt instead? How much closer would you be towards getting that new car or being debt free?

Find a goal you want to achieve. Talk to your family and see if you have something you can work towards together. By setting a goal that everyone wants, you will all be more aware of your spending and will contribute towards reaching it more quickly.

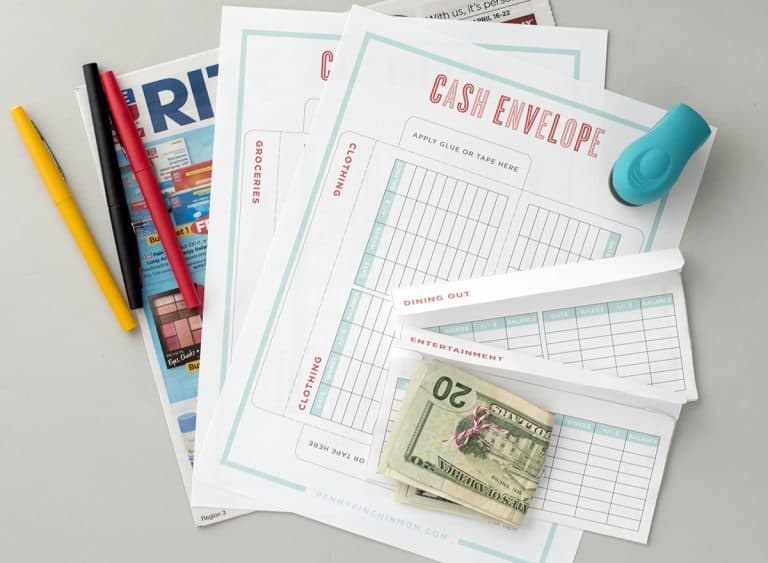

11. STOP SPENDING MONEY WHEN YOU TRACK YOUR SHOPPING

I know many people who have tried to use cash, and they say it does not work because they spend it too quickly. There are others I know who spend too much on plastic each month. The reason is that they are not tracking what they spend, which is a reason why they overspend.

If you use cash, this is where the envelope system is most helpful. You will track your spending out of each one so you can see where your money is going. As the envelope amount gets smaller and smaller, you think twice before you pick up that item — because you may not be able to afford it.

You can do this same thing if you use plastic. There are all sorts of tracking apps to help you monitor what you are spending on all of your various categories.

No matter how you pay for items, make sure you are always tracking what you spend – you might be shocked to learn where your money goes.

Read more: Creating and Understanding a Spending Plan

12. DON’T FALL FOR THE SALES

When you walk into the store, pay no mind to the sales. Use your list and stick to it. Don’t fall for the fancy sales signs, smells, and flashing lights to lure you into buying something you don’t need.

Read more: Understanding the Tricks Stores Use to Get You to Spend Money

Before you can gain control of your finances, you need to figure out why you are spending more than you should. Simple changes to the way you view money can make all the difference.